Enacting a Bitcoin treasury strategy changes more than reserve composition. It redefines capital strategy, risk posture, and market positioning—especially for companies preparing for public markets.

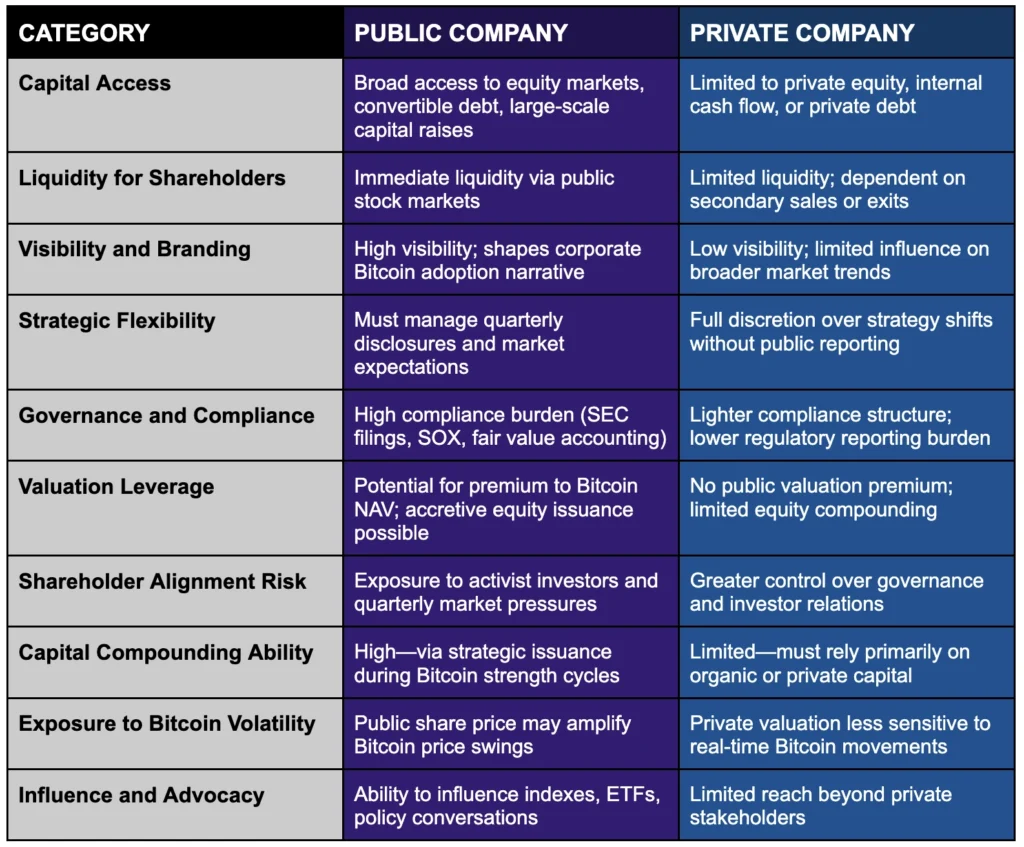

For pre-IPO companies considering or building a Bitcoin treasury strategy, the decision between remaining private or transitioning to public life is not simply regulatory. It is a strategic choice that impacts capital access, shareholder alignment, treasury scalability, and long-term competitiveness.

Understanding the differences between public and private Bitcoin treasury strategies is essential for companies positioning themselves for the next stage of growth.

Strategic Advantages of Being a Public Bitcoin Treasury Company

Access to Public Capital Markets

Public companies have a decisive edge in capital formation. Through equity offerings, convertible debt, and other financial instruments, public companies can efficiently raise significant funds—capital that can be deployed to scale Bitcoin reserves without heavily burdening operations or existing equity structures.

Liquidity for Shareholders and Stakeholders

A public listing provides liquidity opportunities for founders, employees, and early investors. Liquidity strengthens talent recruitment and retention by offering a clear monetization path—an important consideration for growing companies competing for top talent.

Visibility and Market Leadership

Public companies command greater visibility with institutional investors, sovereign wealth funds, and strategic partners. They are positioned to lead the narrative around corporate Bitcoin adoption rather than merely participating in it.

Potential Premium to Bitcoin Holdings

In favorable market environments, public Bitcoin treasury companies have historically traded at premiums relative to the net value of their Bitcoin holdings. This dynamic allows for accretive equity issuance, compounding shareholder value and Bitcoin reserves simultaneously.

Influence in Capital Markets and Policy Arenas

Public Bitcoin companies gain access to indexes, ETFs, analyst coverage, and broader capital markets influence—accelerating adoption not only within their own walls but across the entire corporate landscape.

Managing Trade-Offs in Public Markets for Bitcoin Treasury Strategy

Regulatory and Compliance Requirements

Going public introduces SEC reporting (10-Qs, 10-Ks, 8-Ks), Sarbanes-Oxley compliance, fair value Bitcoin accounting, and governance enhancements. These requirements increase operational complexity but also professionalize treasury operations for long-term scale.

Short-Term Market Pressures

Public companies must manage quarterly disclosures, market volatility, and investor communications—particularly when Bitcoin’s natural price cycles diverge from broader market trends.

Dilution Risk

Strategic equity issuance must be carefully managed to avoid diluting shareholder value. However, with disciplined execution, companies can leverage market demand to enhance Bitcoin accumulation per share.

Exposure to Activist Investors

Public visibility can attract activist pressure, particularly if Bitcoin strategy execution is misaligned with shareholder expectations. Prepared governance structures are key to navigating this dynamic.

Strategic Constraints of Remaining Private

Limited Capital Access

Scaling Bitcoin reserves to a significant strategic level often requires access to public capital. Private fundraising avenues, while viable for early growth, can restrict the ability to move opportunistically or at scale.

Reduced Liquidity for Stakeholders

Private shareholders face limited liquidity pathways absent a sale or private secondary market transactions. This can slow talent recruitment and reduce strategic flexibility during Bitcoin market cycles.

Lower Visibility and Market Influence

Private Bitcoin treasury companies operate with less visibility, making it harder to influence institutional adoption trends, attract strategic partnerships, or advocate for Bitcoin’s role in corporate finance at scale.

Why Public Alignment Supports Bitcoin Treasury Scale

For companies committed to a Bitcoin treasury strategy, public market access is more than a funding mechanism.

It is a force multiplier that enables:

- Strategic compounding of Bitcoin reserves through equity market dynamics

- Attraction of Bitcoin-aligned institutional shareholders

- Long-term positioning as a leader in the emerging corporate Bitcoin economy

- Enhanced flexibility to navigate future macroeconomic and capital market shifts

Bitcoin is a long-duration, scarce, non-sovereign asset. Public companies are best positioned to align their capital strategy, governance structure, and shareholder base to match that time horizon.

Private companies may accumulate Bitcoin successfully.

But public companies have the ability to scale, signal leadership, and institutionalize Bitcoin adoption across global markets.

Conclusion: Building Bitcoin Treasury Strategy for Life in Public Markets

For pre-IPO companies already preparing for the public stage, Bitcoin treasury strategy should be part of the capital strategy conversation today—not after IPO.

Public companies have the tools to:

- Raise capital at scale

- Compound Bitcoin reserves accretively

- Shape corporate adoption narratives

- Strengthen resilience through monetary neutrality

Remaining private offers near-term flexibility.

But operating as a public company unlocks strategic levers that private structures cannot replicate.

For companies thinking long-term about balance sheet resilience, Bitcoin accumulation, and institutional positioning, the imperative is clear:

Build Bitcoin treasury strategy with public market alignment in mind. Prepare not just to participate—but to lead.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities.