I wrote on 18th May that the best trades for the week would be:

- Long of the NASDAQ 100 Index following a daily (New York) close above 22,161. This did not set up.

- Long of the S&P 500 Index following a daily (New York) close above 6,142. This did not set up.

- Long of Bitcoin following a daily (New York) close above $106,187. This set up last Tuesday and produced a win of 0.70%.

- Short of the USD/ZAR currency pair following a daily (New York) close below 17.98. This set up last Tuesday and produced a win of 0.83%.

The overall win of 1.53% equals a win of 0.38% per asset.

Last week saw market sentiment move into a more risk-off zone, due to two major factors:

- President Trump’s tax bill looks like failing in Congress, which wants to water it down in a way that would severely reduce the expenditure reductions which Trump wanted. Republicans have only a narrow majority in the House of Representatives, so Trump is not in such a strong position here to force through everything he wants into the Bill. This makes analysts less optimistic about debt reduction.

- After weeks of only happy noises emanating from the “trade war” which has been kicked into the sidelines, the July deadline begins to approach, and last week saw Trump going back to making quite aggressive statements. This time the EU was on the receiving end, with President Trump saying they are not negotiating in good faith, and suggesting a 50% tariff on all imports could be imposed within a week.

Last week’s most important data releases were:

- UK CPI (inflation) – this came in considerably higher than expected, at 3.5% annualized.

- RBA Cash Rate & Rate Statement – interest rates were cut by 0.25% as expected, the language on inflation was just a touch hawkish.

- Canada CPI (inflation) – some of the data was a bit higher than expected.

- USA, Germany, UK, France Flash Services / Manufacturing PMI – US data was good, the rest was not.

- UK Retail Sales – better than expected.

- Canada Retail Sales – better than expected.

- US Unemployment Claims – almost exactly as expected.

The coming week has what will probably turn out to be a more important schedule of high-impact data releases.

This week’s important data points, in order of likely importance, are:

- US Core PCE Price Index

- US FOMC Meeting Minutes

- US Preliminary GDP

- German Preliminary CPI (inflation)

- Australian CPI (inflation)

- RBNZ Official Cash Rate, Rate Statement, and Policy Statement

- US Unemployment Claims

The most impactful events on the Forex market will likely be the RBA policy meeting, followed by the two items of inflation data.

For the month of May 2025, I made no monthly forecast as although there was a long-term trend against the US Dollar, the price action suggested that a major bullish reversal could be underway.

As there were no unusually large price movements in Forex currency crosses over the past week, I make no weekly forecast.

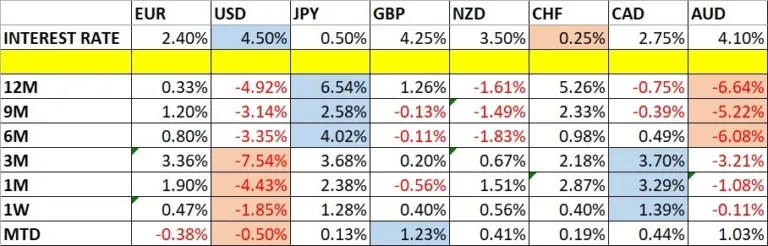

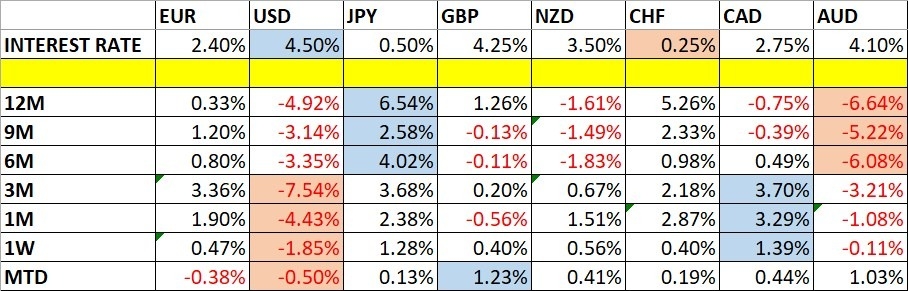

The Canadian Dollar was the strongest major currency last week, while the US Dollar was the weakest. Volatility increased last week, with 26% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to remain at a similar level.

You can trade these forecasts in a real or demo Forex brokerage account.

Last week, the US Dollar Index printed a large bearish candlestick which closed right on its low. The weekly closing price was the lowest since March 2022. These are very bearish signs and suggest that we are seeing momentum in the direction of the long-term bearish trend.

The bullish case is represented by the fact that the price has not yet broken the multi-year low, and in this area at the low we have a horizontal level which has already proved to be strong support, at 97.67.

I think it makes sense to be trading in line with the long-term trend which will be short of the greenback. If there is short-term bearish momentum when the price opens this week, you should be more confident in going short here.

The S&P 500 Index fell last week as risk sentiment deteriorated, with the price ending the week looking a bit heavy on the support level at 5,777 which is also confluent with the 200-day moving average, as can be seen in the daily chart below.

President Trump’s new threat of a 50% tariff on imports from the European Union, and the fact that his tax bill is running into serious difficulty in passing through Congress, have seen stocks softer in recent days.

The outlook is more bearish. I will be very happy to go long of this Index in the unlikely event that we get a daily close above 6,142. However, it may be that this level at 5,777 is very pivotal, so it might be traded either long or short depending upon the price action that happens here as the new week gets underway.

Bitcoin made a powerful bullish breakout on Tuesday to a new all-time high and quickly reached a climax at $112,000 before falling quite sharply. On Sunday, the price was trading barely above $107,000. However, this is a retracement of only about 1.5 daily ATRs so the bullish trend is intact and plenty of trend traders will still want to be involved here on the long side.

Despite this bullish outlook, it is worth nothing that the highest daily closing price should ideally still be exceeded before entering a new long trade here, and that is further ahead at $111,743. Some traders will want to be even more cautious and wait for a new absolute high to be made above the more significant round number above that at $112,000.

It is hard to say why Bitcoin spiked higher: the Trump Presidency seems to generate faith in crypto bulls.

I will enter a new long trade if we get a daily (New York) close above $111,743 this week.

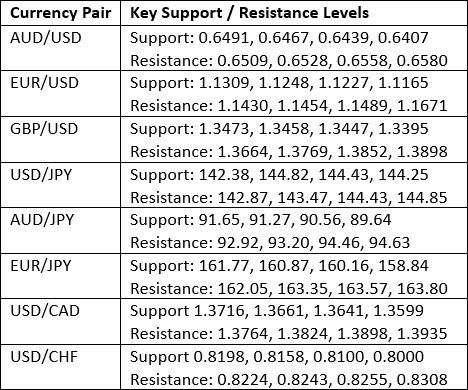

The GBP/USD currency pair was consolidating just below the multi-year high below $1.3500 before suddenly making a strong bullish breakout on Friday to a new 4-year high price well above $1.3500.

There are no bearish signs, and the fact that the price closed right on the weekly high is another bullish sign showing strong bullish momentum.

The British Pound has been one of the stronger major currencies for a while, which increases its bullish credibility. This is partly because inflation in the UK rose significantly last week, the annualized CPI unexpectedly climbing from 2.6% to 3.5%, making the relatively high interest rate of 4.25% likely to persist.

I am happy to be long of this currency pair right now.

The USD/ZAR currency pair looks heavy after breaking below 17.98 earlier in the week and falling to a new 5-month low, targeting the support level at 17.62.

I wrote last week that this could be a wise short trade, and I was correct.

With so much bearish momentum proven by the price closing right on the low, I have no reason to change my mind, and so I still see this as likely to be a good short trade with a profit target at 17.62.

There are reasons (trade war) for some weakness in the USD but the strength in the South African Rand is harder to explain. Many analysts point to relatively high and strong Gold prices, with South Africa getting pulled along as a major Gold producer. I suspect there is another factor, which is that the South African President would not have been invited to meet Trump at the White House if there wasn’t some deal being made that will put South Africa’s terms of trade in a better place, whatever the hostile headlines are saying.

I see this currency pair as a good short trade right now.

I see the best trades this week as:

- Long of Bitcoin following a daily (New York) close above $111,743.

- Long of the GBP/USD currency pair.

- Short of the USD/ZAR currency pair.

Ready to trade our Forex weekly forecast? Check out our list of the top 100 Forex brokers in the world.