Charlotte EdwardsBusiness reporter

Getty Images

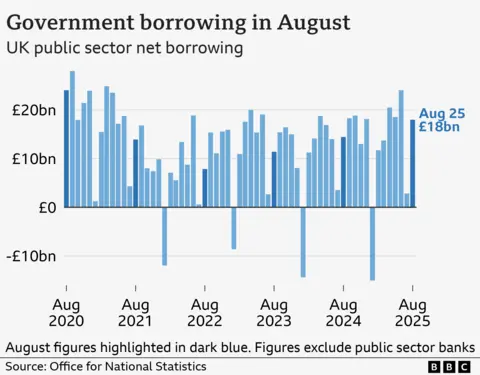

Getty ImagesUK government borrowing in August hit the highest level for the month in five years, latest figures show, adding to the pressure on the chancellor ahead of the Budget.

Borrowing – the difference between public spending and tax income – was £18bn in August, the Office for National Statistics (ONS) said, which was higher than analysts had expected.

Despite tax and National Insurance receipts increasing, they were outstripped by higher spending on public services, benefits and debt interest, the UK statistics body said.

One analyst said Rachel Reeves faced “tough choices” in the Budget to meet her tax and spending rules, with speculation building that taxes will rise.

The latest borrowing figure for August is the highest for the month since the height of the Covid pandemic.

Borrowing over the first five months of the financial year has now reached £83.8bn, which is £16.2bn higher than the same period last year.

It is also above the prediction of £72.4bn that the government’s official forecaster, the Office for Budget Responsibility, had made in March.

James Murray, Chief Secretary to the Treasury, said the government had “a plan to bring down borrowing because taxpayer money should be spent on the country’s priorities, not on debt interest”.

“Our focus is on economic stability, fiscal responsibility, ripping up needless red tape, tearing out waste from our public services, driving forward reforms, and putting more money in working people’s pockets,” he added.

Interest payments on government debt rose by £1.9bn to £8.4bn, partly due to inflation pushing up costs, the ONS said.

Welfare spending increased by £1.1bn to £27.3bn, largely driven by inflation-linked benefit rises and higher State Pension payments.

Paul Dales, chief UK economist at Capital Economics, said the latest figures, “highlight the deteriorating nature of the public finances even though the economy hasn’t been terribly weak”.

He added that this would contribute to the chancellor having to find money in November’s Budget, “mostly through higher taxes”.

Nabil Taleb, an economist at PwC UK, said: “Months of high borrowing and the political challenge of cutting spending have all but wiped out the chancellor’s headroom.”

He said Reeves now faced “tough choices, and the test will be whether she can make them palatable to voters and markets”.

Separate data from the ONS showed that good weather brought a boost to the High Street in August.

Retail sales rose by 0.5% during the month, slightly higher than analysts had expected, with butchers, bakers, clothing stores and online shopping all reporting growth.

The figures come despite warnings from some retailers in recent days of cost pressures and price rises.

However, the monthly shop sales data from the ONS can be volatile.

Over the three months to August sales declined by 0.1%, the ONS said, compared with the three months to May.