I’m convinced that Nutella is the second most important invention after the wheel. So yes, I’m an unapologetic hazelnut fan.

That said, a few months ago I started to notice something odd. The price of natural hazelnuts had more or less doubled. Shortly after, they became surprisingly hard to find, at least in supermarkets where they had always been readily available.

That caught my attention. And it made me wonder whether something unusual had happened, or was still unfolding, in the hazelnut market.

Hazelnuts: a commodity shock without a market

Hazelnuts are a small commodity with an unusually concentrated supply chain. Around 70% of global production comes from Turkey, with output overwhelmingly concentrated in the Black Sea region, where soil, rainfall and climate conditions are uniquely well suited to hazelnut trees. Few agricultural commodities display such geographic dependence.

That concentration extends beyond geography into labour. Roughly 600,000 farmers grow hazelnuts in Turkey, mostly on small, family-owned plots. Including processing, logistics and trade, an estimated five million people are directly or indirectly involved in the hazelnut economy. Production is fragmented, local and labour-intensive, a structure that shapes how the market functions in times of stress.

An opaque market by design

Hazelnuts do not trade on any major agricultural exchange. There are no futures contracts, no central clearing, and no benchmark price. Transactions are negotiated directly, often verbally, between farmers, wholesalers and exporters. Prices are quite literally “called on the phone”.

This makes the market largely inaccessible to non-commercial participants and almost invisible from a traditional commodity-market perspective. Yet physical supply and demand still clear, and when supply is disrupted, prices can move violently.

A rare but severe supply shock

In April 2025, hazelnut growers along Turkey’s Black Sea coast woke up to the worst possible surprise: a late frost sweeping through the region. Frosts like this are rare, maybe once a decade, but this one landed at exactly the wrong moment.

The spring had been unusually warm, pushing hazelnut trees to bud and flower earlier than normal. When temperatures suddenly dropped, the trees were completely exposed. The damage was immediate and widespread. Early estimates suggest around one-third of Turkey’s hazelnut crop was wiped out in a matter of days.

And the frost was only part of the story. Turkish growers had already been dealing with mounting pressures. The brown marmorated stink bug, which arrived in the country around 2017, has become a persistent threat, capable of destroying 10–20% of output in bad years. On top of that, the summer of 2024 was the hottest and driest in more than 60 years, leaving trees stressed and less resilient going into the 2025 season.

By the time the frost hit, the crop had little margin for error, and the market has been paying the price ever since.

Taken together, the result is a severe imbalance: available supply in 2025 is likely to meet only about half of global demand.

How prices behave without a benchmark

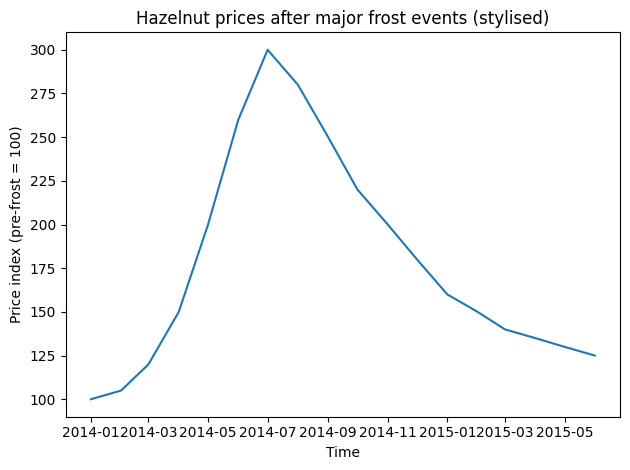

History provides a guide to what happens next. Following similar frost events in 2004 and 2014, hazelnut prices more than tripled. In the 2014 episode, prices began rising immediately after the frost in March, peaked in late April to early May 2015, and then fell by roughly 50% within one to two months as demand adjusted and inventories were released.

Chart 1 illustrates this typical pattern by using a stylised price index. The spike is sharp, front-loaded and driven by physical scarcity rather than speculative positioning. The subsequent correction reflects demand rationing rather than a recovery in supply.

A problem with the structure of the supply

When the price of hazelnuts goes up, supply doesn’t rush in to meet it. There is no easy answer. It takes years for hazelnut trees to grow up, you can’t plant new orchards overnight, and there aren’t many other countries that can grow them. Most of the production still comes from small, family-run farms that don’t have much access to capital and can’t grow even when prices are high.

Because of this rigidity, shocks in the hazelnut market tend to look awful. The market doesn’t make small changes; instead, it swings suddenly: prices go up, volumes go down, and buyers have to adapt on the fly.

-1769951290708-1769951290709.png&w=1536&q=95)

Chart 2 captures the core of the current problem: demand remains broadly intact, but supply has been structurally impaired.

A market that matters, even though it’s hard to see

Hazelnuts may not be in the world of futures contracts and electronic trading screens, but they are an important part of the global food supply chain. There is steady demand for spreads, chocolates, biscuits, and baked goods, and it will be hard to find something else to fill the gap in the short term.

Combine that demand with a highly concentrated production base, rising climate volatility and biological risks, and the result is a market that is unusually fragile. When something goes wrong, there are few buffers, and the adjustment is sudden, not smooth.

The lesson from 2025 is not just about hazelnuts. It is about how physical commodities behave when there is no buffer of inventories, no financial market to absorb shocks, and no rapid supply response. In such markets, scarcity does not emerge gradually; it arrives all at once.