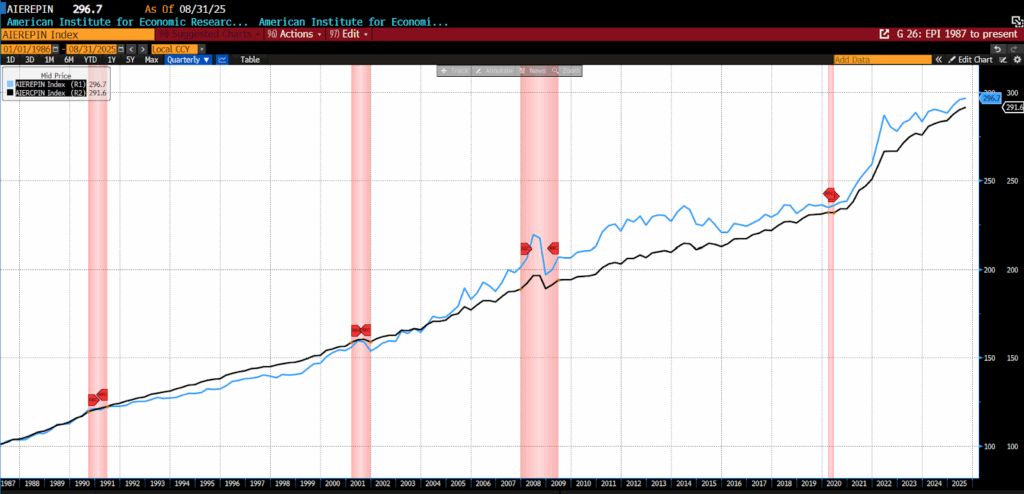

The AIER Everyday Price Index (EPI) rose 0.29 percent to 297.6 in September 2025, marking its tenth consecutive monthly increase and bringing the year-to-date change to roughly 3.2 percent. Out of the 24 components, 15 categories posted price increases, one was unchanged, and eight declined. The strongest gains came from gardening and lawncare services, motor fuel, and intracity transportation, reflecting both seasonal and energy-related pressures. Offsetting those, the most notable price declines occurred in nonprescription drugs, admissions to movies, theaters, and concerts, and housing fuels and utilities, indicating modest relief in select consumer essentials.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

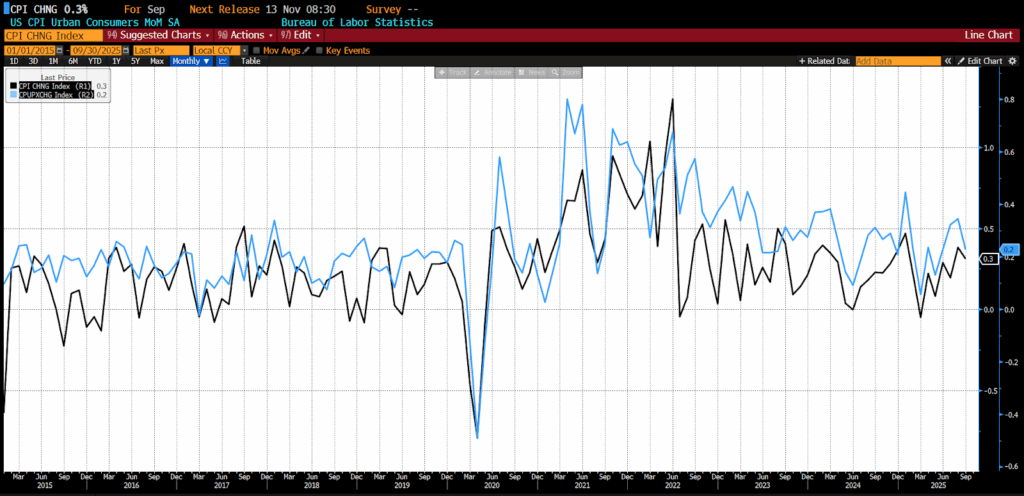

Also on October 24, 2025, the US Bureau of Labor Statistics (BLS) released its September 2025 Consumer Price Index (CPI) data. The month-to-month headline CPI rose 0.3 percent while the core month-to-month CPI number increased by 0.2 percent, both of which were lower than forecasts by 0.1 percent.

September 2025 US CPI headline and core month-over-month (2015 – present)

In September 2025, the food index rose 0.2 percent following a 0.5 percent increase in August, with food at home prices climbing 0.3 percent as four of six major grocery categories posted gains, including other food at home (0.5 percent), cereals and bakery products (0.7 percent), nonalcoholic beverages (0.7 percent), and meats, poultry, fish, and eggs (0.3 percent), while dairy products declined 0.5 percent and fruits and vegetables remained unchanged, and food away from home increased a modest 0.1 percent. Energy costs surged 1.5 percent in September, accelerating from August’s 0.7 percent rise, driven primarily by gasoline prices that jumped 4.1 percent, while electricity fell 0.5 percent and natural gas dropped 1.2 percent.

Core inflation, excluding food and energy, moderated to 0.2 percent in September from 0.3 percent in each of the previous two months, with shelter costs rising 0.2 percent as owners’ equivalent rent posted its smallest monthly gain (0.1 percent) since January 2021.

Also in the core numbers, transportation costs were mixed, with airline fares increasing 2.7 percent and new vehicles rising 0.2 percent as motor vehicle insurance and used cars and trucks both declined 0.4 percent. Other notable changes included recreation and household furnishings each rising 0.4 percent, apparel gaining 0.7 percent, personal care up 0.4 percent, and communication falling 0.2 percent. Medical care costs increased 0.2 percent overall, with hospital services and prescription drugs each rising 0.3 percent, offsetting declines in dental services (down 0.6 percent), and physicians’ services (down 0.1 percent).

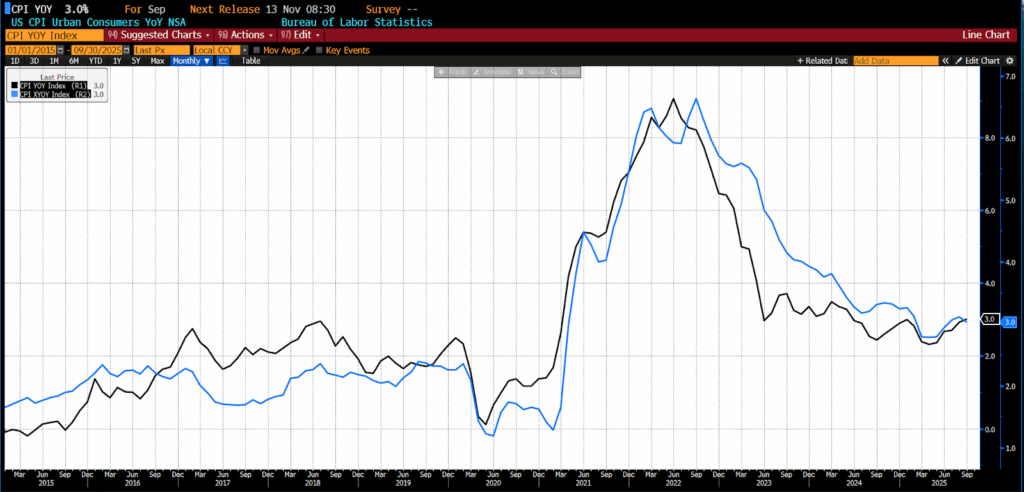

Tracking changes over the previous 12 months, both the headline and core Consumer Price Indices rose 3.1 percent, slightly higher than the 3.0 percent rise that was projected for both.

September 2025 US CPI headline and core year-over-year (2015 – present)

Over the 12 months ending in September, overall food prices increased 2.7 percent, with grocery prices holding steady from August while dining-out costs accelerated to a 3.7 percent annual pace. Within food categories, meats, poultry, fish, and eggs climbed 5.2 percent, and nonalcoholic beverages rose 5.3 percent, while “other food at home” advanced 1.9 percent and cereals and bakery goods were up 1.6 percent. Energy prices rose 2.8 percent over the year, led by steep gains in electricity (5.1 percent) and natural gas (11.7 percent), though gasoline edged 0.5 percent lower. Full-service restaurant meals rose 4.2 percent compared with 3.2 percent for limited-service meals, while fruits and vegetables gained 1.3 percent and dairy prices were up a modest 0.7 percent.

Core CPI, which excludes food and energy, increased 3.0 percent year-over-year, driven primarily by shelter costs, which advanced 3.6 percent. Other notable contributors included household furnishings and operations (4.1 percent), used cars and trucks (5.1 percent), medical care (3.3 percent), and recreation (3.0 percent). These figures highlight that while goods inflation has moderated, services and housing remain the key sources of upward price pressure within the core index.

The September 2025’s Consumer Price Index report delivered news of a welcome moderation in inflation, marking the slowest pace of underlying price growth in three months. Core CPI was restrained by a cooling in shelter costs — the smallest increase in owners’ equivalent rent since early 2021. Broader price movements were similarly tame: goods inflation eased on cheaper used cars and slower gains in household furnishings, while services inflation was capped by softening rents and airfare costs. Of note, the data release was delayed by the ongoing federal shutdown and assembled primarily to ensure the Social Security Administration could calculate its 2.8 percent cost-of-living adjustment for next year.

For policymakers at the Federal Reserve, the report reinforces confidence that price pressures are continuing to cool without threatening broader economic stability. The slower pace of inflation, particularly across shelter and core services, effectively seals the case for a 25-basis-point rate cut at the late-October Federal Open Market Committee meeting and strengthens the likelihood of another in December. The immediate financial market reaction reflected that view: Treasury yields, and the dollar slipped, while stock futures advanced. Despite persistent tariff exposure — particularly in categories like apparel and household goods — the overall pass-through to consumers remains modest. Estimates suggest firms passed through roughly 26 cents of every dollar in new tariff costs, underscoring how competitive pressures and slowing demand are muting inflation’s reach.

Still, the data paint a nuanced picture beneath the headline calm. Measures of inflation breadth show that while fewer items posted outsized increases, nearly half of core CPI components continue to rise at an annualized rate above 4 percent, signaling lingering while narrowing stickiness. The primary concern now is not so much inflation’s direction but data continuity: with the government still shuttered, the Bureau of Labor Statistics has suspended most data collection, casting doubt on the release and accuracy of upcoming CPI reports. For the moment, though, September’s figures offer reassurance that inflation is on a slower glide path — enough to justify the Fed’s easing bias but not yet soft enough to rule out renewed vigilance if tariff or supply shocks reemerge over the next several months.