Note: The December 2025 readings for both the Consumer Price Index and the Everyday Price Index should be viewed as provisional rather than definitive. A temporary government funding lapse interrupted standard federal price collection, leaving gaps that could not later be filled and forcing reliance on limited alternative inputs. Data collection resumed partway through November, restoring more normal coverage only as the month progressed.

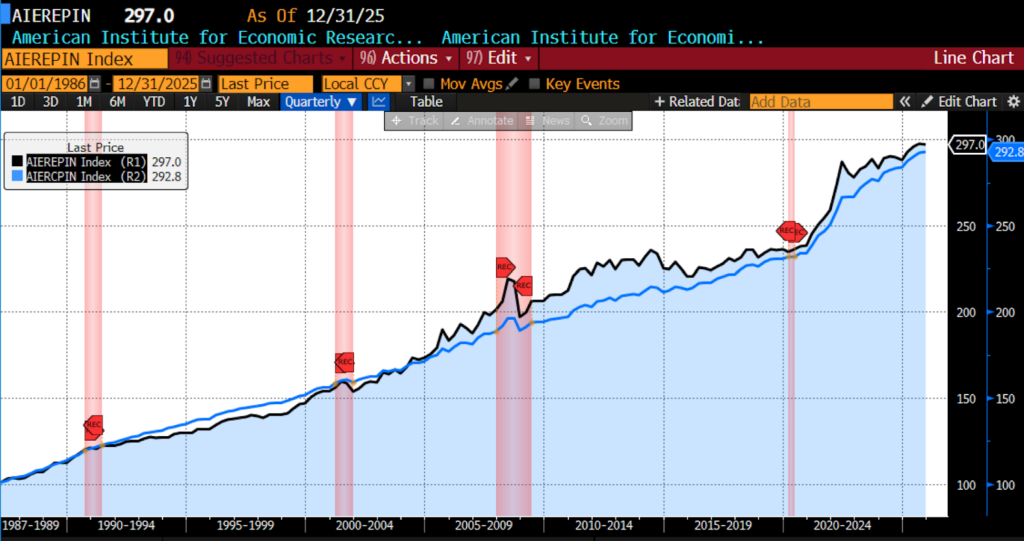

The AIER Everyday Price Index (EPI) ended 2025 by rising a scant 0.04 percent in December, essentially flat for the month. The annual change in AIER’s EPI for 2025 was 3.02 percent versus our CPI proxy’s increase of 3.10 percent. Of its 24 constituents, December 2025 saw the prices of 15 rise, six decline, and three remain unchanged. The largest price increases within the EPI were seen in the food-at-home, food-away-from-home, and fuels and utilities categories. Motor fuel, information technology hardware and services, and alcoholic beverages at home saw the steepest declines in price.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

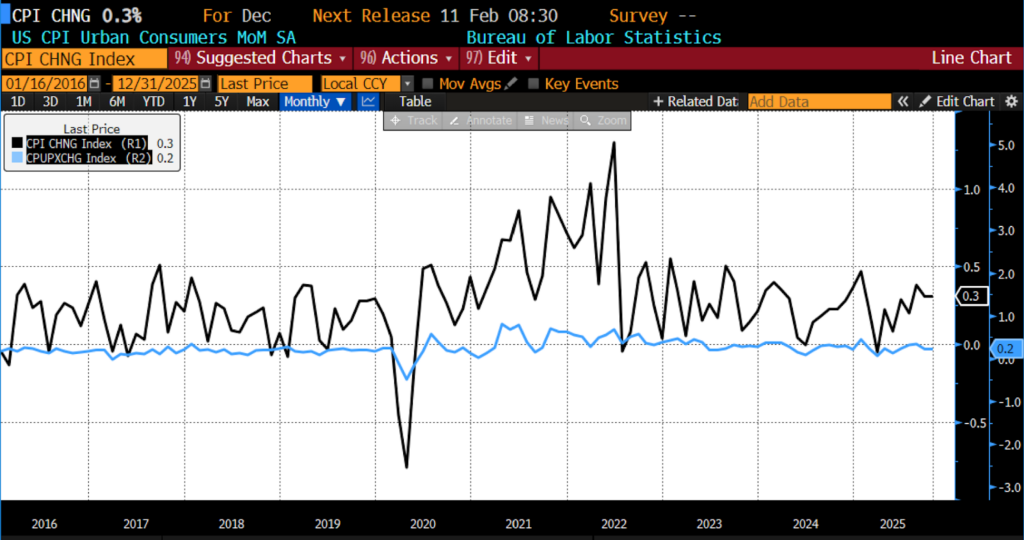

Also on January 13, 2026, the US Bureau of Labor Statistics (BLS) released Consumer Price Index (CPI) data for December 2025. Headline inflation rose 0.3 percent in December, meeting surveyed expectations. Core inflation rose 0.2 percent, less than the 0.3 percent that was forecast.

December 2025 US CPI headline and core month-over-month (2015 – present)

Consumer prices in December 2025 were shaped in part by continued firming in food costs, with overall food prices rising 0.7 percent on the month. Grocery prices posted a similar increase, as most major store categories moved higher, led by notable gains in “other food at home,” dairy products, cereals and bakery items, fruits and vegetables, and nonalcoholic beverages, while declines in meats, poultry, fish, and eggs — driven by a sharp drop in egg prices — partially offset those increases. Dining out also became more expensive, as prices for meals away from home rose 0.7 percent, reflecting higher costs at both full-service and limited-service establishments. Energy prices edged higher as well, increasing 0.3 percent in December, with a sizable jump in natural gas prices outweighing modest declines in gasoline and electricity.

Excluding food and energy, the core index advanced 0.2 percent for the month, as upward pressure from shelter, recreation, medical care, apparel, personal care, education, and airline fares more than offset declines in communication services, used vehicles, and household furnishings. Shelter costs remained a key contributor to underlying inflation, rising 0.4 percent, with rents and owners’ equivalent rent posting steady increases and lodging away from home recording a notable gain. Among other components, recreation prices surged, airline fares climbed sharply, and medical care costs rose on the back of higher hospital and physician service prices, while categories such as communication services and used vehicles continued to exert downward pressure on the overall index.

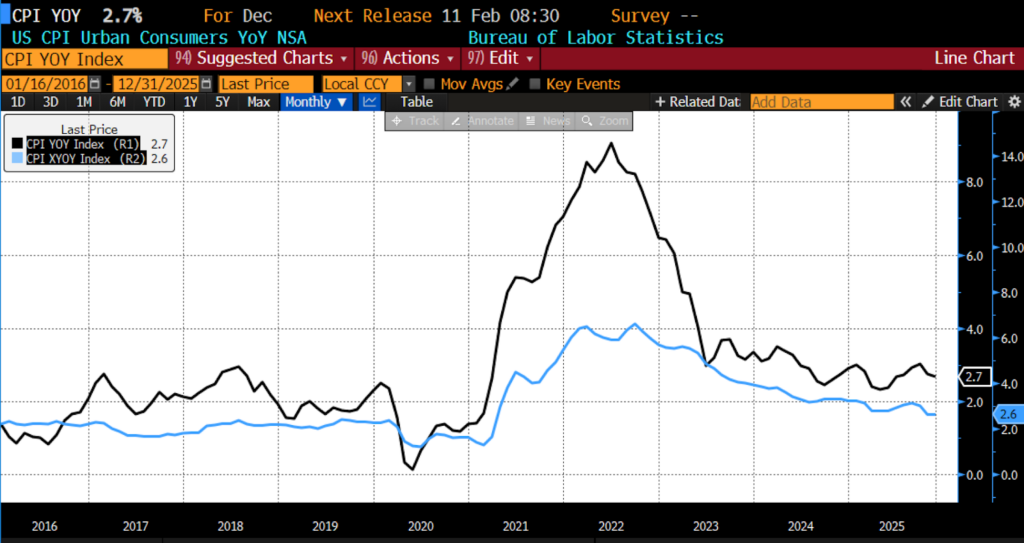

On the year-over-year side, December 2025 headline data rose to 2.7 percent, which matched forecasts. The core index, which excludes food and energy, rose 2.6 percent — slightly less than the expected 2.7 percent.

December 2025 US CPI headline and core year-over-year (2015 – present)

Over the twelve months from December 2024 to December 2025, food prices continued to rise at a moderate but uneven pace, with grocery costs increasing 2.4 percent overall. Within food at home, price gains were led by meats, poultry, fish, and eggs, which rose 3.9 percent, alongside notable increases in nonalcoholic beverages and other food at home, while cereals and bakery products and fruits and vegetables posted more modest advances. In contrast, dairy and related products declined slightly over the year. Prices for meals away from home increased more rapidly than grocery prices, rising 4.1 percent on a year-over-year basis, reflecting stronger gains at full-service restaurants and a more moderate increase at limited-service establishments. Energy prices also moved higher over the year, increasing 2.3 percent, as sizable advances in electricity and natural gas more than offset a decline in gasoline prices.

Over the past 12 months, shelter costs have remained a primary source of underlying inflation in the core index, increasing 3.2 percent. Additional upward pressure came from medical care, household furnishings and operations, recreation, and personal care, all of which posted solid year-over-year gains, reinforcing the persistence of price increases across a broad set of service-oriented categories.

December’s CPI report reinforced the idea that the October-November release’s softer inflation reading was not merely a statistical fluke but part of a broader cooling pattern, particularly in goods prices. Headline inflation rose modestly on the month, while core inflation again came in below expectations, leaving both measures unchanged on a year-over-year basis at roughly the mid-2 percent range. A key takeaway was that core goods prices remained flat, driven in part by further declines in used vehicle prices and broad-based price cuts in tariff-exposed categories including appliances, electronics, and certain household goods. That pattern aligns closely with private sector tracking of online prices, which suggests that tariff passthroughs peaked in early autumn and have since faded. While food prices accelerated in December 2025 — especially for both grocery and restaurant categories — and energy made a small positive contribution, the broader inflation picture increasingly reflects stabilization rather than renewed pressure.

Service prices remain the central battleground. Shelter costs rebounded modestly in December after being artificially restrained by shutdown-related data distortions in the fall, but rent and owners’ equivalent rent increases remained consistent with their average pace for the year. Outside of housing, service price pressures were mixed: travel-related categories such as hotels and airfares bounced back following the end of the government shutdown, while medical services rose steadily, reflecting persistent labor cost pressures in healthcare. Importantly, measures closely watched by the Federal Reserve — such as services inflation excluding housing and energy — continued to trend lower on a year-over-year basis, suggesting underlying progress even as monthly readings fluctuate. At the same time, consumers remain acutely aware of specific high-profile price pressures, most notably in food. Beef prices reached new records in December, driven by structural supply constraints in the cattle industry and resilient demand that may be reinforced by new dietary guidelines emphasizing protein, underscoring how individual categories can feel inflationary even as overall price growth moderates.

The December data reinforce a cautious but increasingly constructive outlook. Federal Reserve officials are widely expected to hold rates steady at their January meeting, preferring to see several more months of confirmation that inflation is leveling off rather than reaccelerating. Financial markets, meanwhile, interpreted the report with some ambivalence: equities rallied briefly on the cooling signal, but bond yields and rate expectations moved little, reflecting lingering uncertainty about whether recent softness represents a durable signal or informationless noise. Still, the broader message from December is that inflation dynamics are becoming more balanced, and that as of now tariff effects appear to have largely run their course. Core goods prices remain subdued and real wage growth has turned positive, both setting the stage for gradual easing later in the year if labor market conditions soften or price pressures continue to fade.