AIER’s Everyday Price Index (EPI) leapt up in the first month of 2025, ending a string of declines which began in August 2024 but retraced slightly in December 2024. The index jumped to 290.9, a level last seen in May 2024, up 2.15 percent on a year-over-year (January 2024 through January 2025) basis.

AIER Everyday Price Index vs. US Consumer Price Index (NSA, 1987 = 100)

Among the twenty-four EPI constituents, 19 rose, 3 declined, and 2 were unchanged from December’s levels. The biggest price gains were encountered in the housing fuels and utilities, motor fuel, and food-at-home categories, while nonprescription drugs, postage and delivery services, and audio discs, tapes, and other media saw the greatest declines.

On February 12, 2025, the US Bureau of Labor Statistics (BLS) released its January 2025 Consumer Price Index (CPI) data. The month-to-month headline CPI number rose by 0.5 percent, much higher than forecasts calling for an 0.3 percent rise. The core month-to-month CPI number rose by 0.4 percent, also higher than the predicted 0.3 percent rise.

The food index increased 0.4 percent in January, driven by a 0.5 percent rise in food at home as four of the six major grocery categories saw price increases. The meats, poultry, fish, and eggs index jumped 1.9 percent, with egg prices soaring 15.2 percent — the largest increase since June 2015 — accounting for two-thirds of the total monthly food at home increase. Prices for nonalcoholic beverages rose 0.9 percent, while dairy and related products and other food at home each increased 0.3 percent.

In contrast, fruits and vegetables fell 0.5 percent, led by tomatoes (-2.0 percent) and other fresh vegetables (-2.6 percent). Cereals and bakery products dropped 0.4 percent, with breakfast cereal prices plunging 3.3 percent. Meanwhile, food away from home increased 0.2 percent, as limited-service meals rose 0.3 percent and full-service meals edged up 0.1 percent.

The energy index rose 1.1 percent in January 2025, driven by a 1.8 percent increase in gasoline and natural gas prices. Gasoline prices climbed 1.8 percent both seasonally adjusted and unadjusted, while electricity costs remained unchanged.

The core index, excluding food and energy, rose 0.4 percent in January, with shelter costs up 0.4 percent. Owners’ equivalent rent and rent both increased 0.3 percent, while lodging away from home jumped 1.4 percent. Medical care costs rose 0.2 percent, driven by a 2.5 percent increase in prescription drugs, 0.9 percent rise in hospital services, and a 0.1 percent uptick in physician services. Motor vehicle insurance climbed 2.0 percent, while recreation increased 1.0 percent and used car and truck prices rose 2.2 percent. Other categories seeing gains included communication, airline fares, and education.

In contrast, apparel prices fell 1.4 percent, and personal care and household furnishings and operations also declined. New vehicle prices remained essentially unchanged for the month.

January 2025 US CPI headline & core month-over-month (2015 – present)

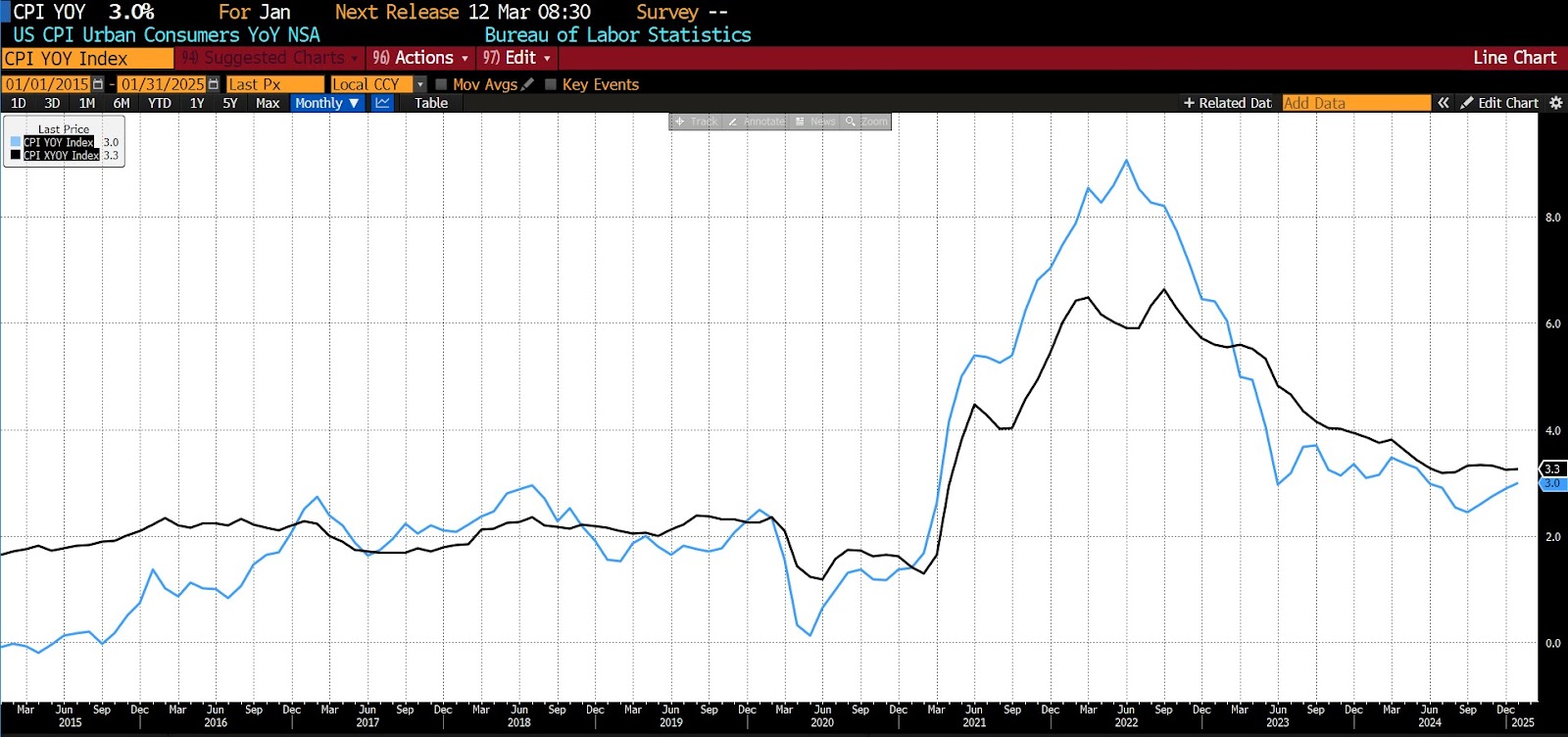

The headline CPI reading came in at 3.0 percent on a year-over-year basis, exceeding the surveyed 2.9 percent expectations. Year-over-year core CPI also rose more than forecast, with the January 2024 to 2025 reading showing a 3.3 versus 3.1 percent increase.

January 2025 US CPI headline & core year-over-year (2015 – present)

The food at home index rose 1.9 percent over the past 12 months, driven by a 6.1 percent increase in meats, poultry, fish, and eggs, with egg prices surging 53.0 percent. Nonalcoholic beverages climbed 2.2 percent, while other food at home increased 0.8 percent and dairy and related products rose 1.2 percent. Cereals and bakery products edged up 0.4 percent, and fruits and vegetables rose 0.3 percent.

Food away from home increased 3.4 percent year-over-year, with limited and full-service meals both up 3.3 percent. The energy index rose 1.0 percent from January 2024 to January 2025. Gasoline prices declined 0.2 percent, and fuel oil dropped 5.3 percent, while electricity rose 1.9 percent and natural gas climbed 4.9 percent.

The core index, excluding food and energy, has risen 3.3 percent over the past 12 months. Shelter costs increased 4.4 percent, marking the smallest annual gain since January 2022. Other notable increases included motor vehicle insurance (up 11.8 percent), medical care (up 2.6 percent), education (up 3.8 percent), and recreation (up 1.6 percent).

The broadening of inflationary pressures were, beyond the size of the increases, a troubling aspect of the BLS report. The share of core spending categories experiencing inflation above 4 percent annualized jumped to 42 percent from 32 percent in December, while the number of categories seeing outright deflation declined to 37 percent from 43 percent. This suggests that inflation is not only persistent but spreading across more sectors of the economy. Some portion of the hot print may be attributed to seasonal distortions, as businesses often reset prices at the start of the year, exaggerating the price effect. Additionally, this year’s January price increase may have been larger than typically seen owing to expectations of tariffs. Even accounting for these factors, January’s inflation data underscores that price stability remains elusive, making it unlikely the Fed will cut rates in the near term.

The Fed’s response will be critical in shaping market expectations moving forward. Chair Jerome Powell has reiterated that the central bank is in no rush to lower rates, and today’s CPI print further cements that stance. Policymakers are also keeping a close watch on new trade policies which have already begun influencing inflation expectations. With real hourly wages rising just 1.0 percent year-over-year, sustained price pressures could begin to weigh on consumer spending. AIER’s Everyday Price Index, which focuses on a narrow group of the most purchased consumer goods, illustrates that potential even more clearly. While it’s too early to declare that inflation is re-accelerating, today’s report is a strong reminder that the path to the Fed’s two-percent target will not be smooth and that financial markets may need to adjust their expectations accordingly.