BBC

BBCAbout a quarter of the working age population – those aged 16 to 64 – do not currently have a job. Caring responsibilities and ill health are the most common reasons given by those who would like one.

With a four-year mandate and a towering majority, Labour might have been expected to have invested in a long-term plan to help those who are sick get back into the workforce, at least part-time. It may have cost up front, but in the future it could have delivered big savings.

Instead its determination to avoid a repeat of the Liz Truss mini-budget led them to target big savings quickly – but it ended up causing perhaps even more trouble, with the government performing a spectacular U-turn to avoid a mass Labour rebellion.

It raises significant questions, not just about how this year-old government manages its affairs day to day, but if its overall strategy to renew the country is on track.

Long-term reform vs short-term savings

The government was adamant that its “welfare reform” changes – announced in March’s Green Paper – were designed to get people back to work.

The bulk of planned savings came from tightening the eligibility for Personal Independence Payments (Pip), which are paid to support people who face extra costs due to disability, regardless of whether or not they are in work.

PA Media

PA MediaIndependent experts questioned whether more of the savings should have been redeployed to help people with ill health ease back in to the workforce, for example part time.

That could mean support such as potential employer subsidies – especially to help get younger people into work and pay taxes, rather than claim benefits long term. It could also help fill jobs – a win win for all.

Labour rebels argued that the upfront cuts were aimed at filling a Budget hole against the Chancellor’s self imposed borrowing rules. Their central criticism was that this was an emergency cost-cutting exercise.

It is true that the Chancellor’s Budget numbers were blown off course by higher borrowing costs, such as those emanating from US President Donald Trump’s shock tariffs, so she bridged the borrowing gap with these cuts.

PA Media

PA MediaThe welfare reform plan to save £5bn a year by 2029-30 helped Chancellor Rachel Reeves meet her “non negotiable” borrowing rules.

Indeed when the Office for Budget Responsibility (OBR), which monitors the spending plans, said they would not in fact raise enough money, Reeves announced more welfare cuts on the day of the Spring Statement.

The main point was to raise money to help close the gap in the Budget forecast.

Insiders tell me that the welfare reform plan was in fact brought forward for this purpose. But this was still not a full programme of welfare reform designed to deal with a structural issue of rising health-related claims.

‘Top slicing never works’

The former Conservative Welfare Secretary Iain Duncan Smith resigned as work and pensions secretary almost ten years ago, saying a similar plan to cut disability benefits was “indefensible”.

He says the cuts should have formed part of “a wider process” of finding the best way to focus resources on those most in need.

“Top slicing never works,” he says of plans to extract savings from the welfare budget without reform.

At its heart the problem is perceived to be that the current welfare structure has become overly binary, failing to accommodate a growing demographic who should be able to do at least a bit of work.

This rigidity – what ministers refer to as a “hard boundary” – inadvertently pushes individuals towards declaring complete unfitness for work, and can lead to total dependence on welfare, particularly universal credit health (UC Health), rather than facilitating a gradual transition back into employment.

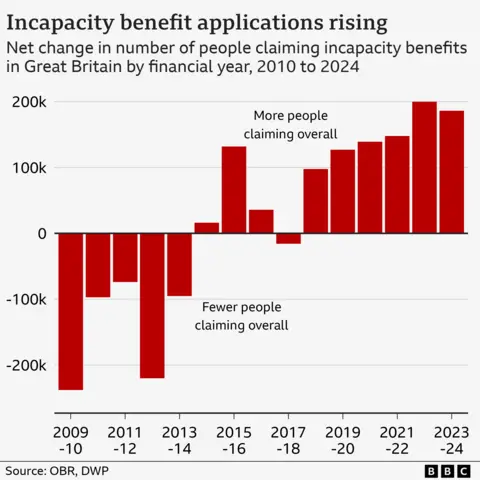

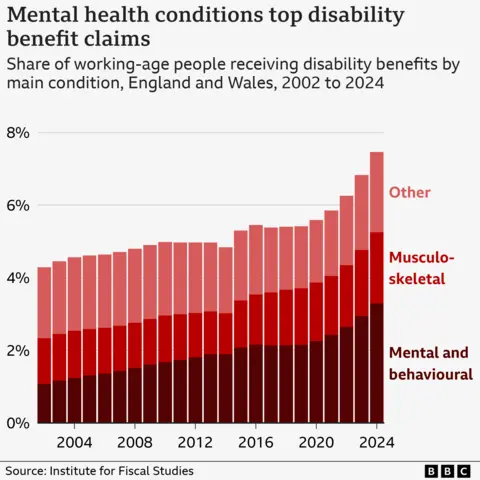

For some leading experts this is, in fact, the biggest cause of the increase in health-related welfare claims. The pandemic may have accelerated the trend, but it started a decade ago.

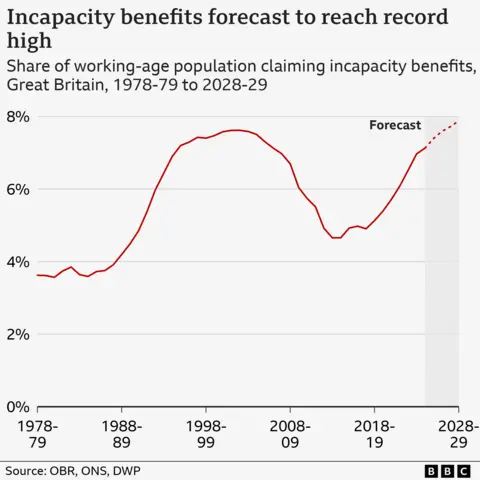

The proportion of working age people claiming incapacity benefit had fallen well below 5% in 2015, now it’s 7%.

The pandemic period exacerbated the rise as ill health rose and many claims were agreed without face-to-face meetings. These claims were also increasingly related to mental ill health.

One former minister, who did not wanted to be named, said the system had effectively broken down.

“The real trouble is people are learning to game the Pip questionnaire with help from internet sites,” he says. “It’s pretty straightforward to answer the questions in a way that gets the points.”

As he puts it, the UK is “at the extreme of paying people for being disabled” with people getting money rather than equipment such as wheelchairs as occurs in other countries.

For most kinds of mental ill health, in kind support, such as therapies, would make more sense than cash transfers, he argues.

But some disability campaigners have said that being offered vouchers instead of cash payments and thereby removing people’s automony over spending, is “an insult” and “dangerous”.

EPA-EFE/Shutterstock

EPA-EFE/ShutterstockThese pressures can be seen in the nature of the compromise reached.

The planned cuts to Pip payments will now only apply to new claimants from November next year, sparing 370,000 current claimants out of the 800,000 expected to be affected by the changes.

Dame Meg Hillier, Labour MP and chair of the Commons Treasury committee, along with other rebels, have also pointed out that the application of the new four-point threshold for Pip payments will be designed together with disability charities.

It is a fair assumption that this so called “co-production” may enable more future claimants to retain this money.

On universal credit, the government had planned to freeze the higher rate for existing health-related claimants but the payments will now rise in line with inflation. And for future claimants of universal credit, the most severe cases will be spared from a planned halving of the payments, worth an average of £3,000 per person.

However, these calculations don’t take into account the effects of £1bn the government has pulled forward to spend to help those with disabilities and long-term health conditions find work as swiftly as possible. This originally wasn’t due to come in until 2029.

This change does help Labour’s argument that the changes are about reform rather than cost cutting. But this is still not fully fledged radical reform on the scale that is needed to tackle a social, fiscal and economic crisis. The OBR has not yet done the numbers.

The Keep Britain Working review, led by former John Lewis boss Sir Charlie Mayfield, which was commissioned by the government to look into the role of employers in health and disability, has not yet been reported.

In the Netherlands, where a similar challenge was tackled two decades ago, their system makes employers responsible for the costs of helping people back into work for the first two years.

Here, businesses are concerned about the costs of tax, wages and employment rights policies. And there is already a fundamental question about whether the jobs are out there to support sick workers back into the workforce.

Tax rises or other spending cuts

The Institute for Fiscal Studies and Resolution Foundation think tanks have estimated the government’s U-turn could cost £3bn, meaning Chancellor Rachel Reeves will either have to increase taxes in the autumn budget or cut spending elsewhere if she is to meet her self-imposed spending rules.

Extending the income tax threshold freeze again, seems a plausible plan There are still a few months to go, so the Treasury might hope that growth is sustained and that borrowing costs settle, helping with the OBR numbers.

PA Media

PA MediaIt will not be lost on anyone that the precise cause of all this, however, was a hasty effort to try to bridge this same Budget rule maths gap that emerged in March.

Significant questions arise about just how stability and credibility-enhancing it really is to tweak fiscal plans every six months to hit Budget targets that change due to market conditions, with changes that cannot be ultimately enacted.

The idea floated by the International Monetary Fund that these Budget adjustments are only really needed once a year must seem quite attractive today.

Is Britain getting sicker?

And then there are bigger questions left hanging.

Is Britain really fundamentally sicker than it was a decade ago, and if it is, does society want to continue current levels of support? If the best medicine really is work, as some suggest, then can employers cope, and will there be enough jobs?

Or was it the system itself – previous welfare cuts – that caused the ramp up in claims in recent years, requiring a more thought-through type of reform? Should support for disability designed to help with the specific costs of physical challenges be required at similar levels by those with depression or anxiety?

Dare this government make further changes to welfare? And, in pursuing narrow Budget credibility, has it lost more political credibility without actually being able to pass its plans into law?

The government is not just boxed in. It seems to have created one of those magician’s tricks where they handcuff themselves behind their backs in a locked box – only they lack the escape skills of a Houdini or Blaine.

There will be relief that the markets are calm for now, with sterling and stock markets at multi-year highs. But an effort to close a Budget gap, has ended up with perhaps even more fundamental questions about how and if the government can get things done.

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can send us your feedback on the InDepth section by clicking on the button below.