Picture this – you arrive on a site tour and you’re met with overgrown landscaping, trash littered across the property, and a leasing office that’s completely deserted. The gutters sag with years of neglect and a quick search reveals a reputation marred by poor Google reviews, an outdated website, and minimal online presence.

It’s clear why rents are trailing the comp set and why we believe we can come in and quickly cure the mismanagement and bring rents to market.

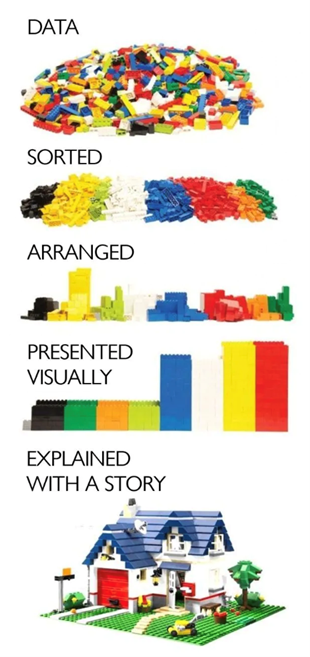

These classic telltale signs of mismanagement and value-add potential are the opening chapter of a compelling investment story.

When investing in real estate, our investor base—primarily family offices and high-net-worth individuals—isn’t just investing in properties; they’re investing in stories.

These stories illustrate how we sourced the deal, why the deal is mispriced, the upside potential, and why the potential rewards outweigh the risks.

Let’s dive into an example, using a typical situation we see today and the story that makes it compelling.

A Compelling Investment Story

Not all deals are created equal—some are broadly marketed and straight down the middle, while others emerge from unique circumstances. This is one of those unique situations we look for.

The property was acquired at the peak of the market in 2021 for $225K/unit by an AUM-driven firm, and financed with short-term floating-rate CMBS debt. Fast forward to late 2024, a failed marketing process left the owner with few options. Now, with a looming loan maturity, they must sell by the end of Q1—urgency is on our side.

Because of our long-standing relationship with the broker and experience in the market, we have the opportunity to move quickly and secure this asset off-market at an attractive $150K/unit—a 30% discount to the prior sale and a 40% discount to replacement cost.

This narrative immediately answers several critical questions:

- Why is the owner selling? They’re under pressure, facing a loan maturity deadline.

- Why are we the right buyer? We have the relationships and ability to move quickly.

- Why is this an attractive deal? We’re acquiring a distressed asset at a steep discount.

This isn’t just another widely shopped deal where we bid the most for it. The seller needs a fast, reliable buyer—and we’re in the perfect position to capitalize and tie it up for a discount.

From here, we dig deeper, building out the full investment story.

The Merits of the Deal

This property is terribly mismanaged and outdated, presenting a clear and supportable value-add opportunity.

The 2.3-star Google rating tells a part of the story: resident complaints about trash buildup, maintenance issues, and security concerns are rampant. Our recent on-site tour confirmed these issues firsthand. This isn’t a case of structural obsolescence—it’s a case of poor operations.

The immediate opportunity? Implement better property management, address deferred maintenance, and improve the resident experience to close the ~$100/unit gap between this property and its inferior comp set. This immediate upside isn’t speculative—it’s driven by basic operational improvements that are well within our control and supported by the comp set.

As value-add buyers, we seek clear, tangible ways to create value. Here, we see two parallel paths:

- A mark-to-market opportunity through better management and curing deferred maintenance.

- Physical value-add play through strategic capital improvements.

This is exactly the type of opportunity we specialize in—one where operational expertise, and targeted renovations, result in outsized returns.

The Value-Add Upside

Built in 2002, the asset boasts 9’ ceilings, strong curb appeal, and ample space for amenities, yet it has remained untouched for over two decades. The upside is clear: modernize the interiors, enhance the existing amenities, add new amenities, and reposition the property to compete at higher rents to serve the growing young professional demographic in the submarket.

Our underwriting assumes a conservative ~$250/unit rent premium, supported by market comps. Property 1 and Property 2, both achieving ~$400/unit higher rents, will be inferior to our post-renovation product—giving us confidence in both our base case and the potential to outperform.

This story resonates with investors because it answers the key questions upfront:

- What’s the business plan? Modernize and reposition.

- Why do we believe in the rent premiums? Proven comps support the upside.

- Where’s the potential for outperformance? A best-in-class product in an improving submarket priced below the comps.

With the foundation of the deal established, we can now take a closer look at the submarket dynamics and why the asset is positioned for potential upside.

The Market

A strong investment story isn’t just about the asset—it’s about the market fundamentals that will drive long-term value.

This property is located in [submarket], a highly desirable area known for A-rated schools (Niche), abundant local conveniences, and easy access to major employment hubs, including:

- Company 1 – X jobs

- Company 2 – X jobs

- Company 3 – X jobs

Over the past three years, new development has kept rent growth in check. However, with lease-ups now stabilizing and no new starts scheduled for 2025, we anticipate a supply/demand imbalance in 2026-2028, fueling outsized rent growth.

Despite this backdrop, we’re underwriting a conservative 3% annual rent growth over our 7-year hold period, while recognizing upside potential if market fundamentals tighten more aggressively than expected.

This is where maps and visuals help drive the story home—showing proximity to demand drivers and reinforcing why this location is primed for long-term demand.

The Returns

No story is complete without a deep dive into the numbers. A strong investment case must be backed by a detailed sources & uses, capex breakdown, key assumptions, summary proforma, economic breakdown, return sensitivities, and rent comps.

At the end of the day, this is an investment—the returns must justify the risk, the deal should offer downside protection, and the fee and promote structure must be fair and aligned with investors.

—

Investors, especially family offices and high-net-worth individuals, don’t just invest in projected returns—they invest in stories, people, and visions. A well-crafted story frames the investment as a unique opportunity, helping investors see beyond the spreadsheet and into the bigger picture.