Business reporter, BBC News

Getty Images

Getty ImagesThe financial regulator’s proposed compensation scheme for car finance mis-selling is “completely impractical”, the trade body for the industry has said.

The boss of the Finance and Leasing Association (FLA) told the BBC there was concerns over the redress scheme potentially covering loans from as far back as 2007, as firms and customers may not have kept records.

It comes after a Supreme Court ruling narrowed the scope on potential payouts over hidden commissions on car loans. However, its judgement left open possible redress for millions of drivers.

The regulator will start consulting in October on the issue of compensation, although it said victims were likely to get less than £950 per deal.

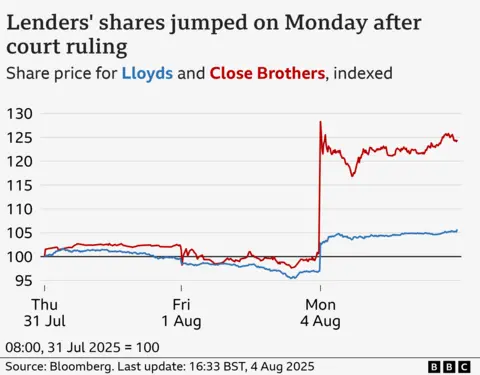

The share prices of some of the main car finance lenders surged on Monday following the ruling, which narrowed the scope of potential payouts.

Shares in Lloyds jumped up 9% while Close Brothers soared by 20%. The two banks had set aside £1.15bn and £165m respectively for potential compensation.

The Financial Conduct Authority (FCA) said on Monday it anticipates requiring firms “as far as possible” to make customers aware of their eligibility and what they need to do to claim compensation if they are found to have been mis-sold finance.

It also said that any claims “should cover agreements dating back to 2007”.

Up to 14 million people could be eligible for compensation, according to Martin Lewis of Money Saving Expert.

But speaking to the BBC’s Today programme, Stephen Hadrill of the FLA said allowing the redress scheme to go back that far was “completely impractical”.

“It’s not just firms that don’t have the details about contracts back then, the customers don’t either,” he said.

“And, if we’re going to have to take careful decisions about who gets compensation, who gets redress, and who doesn’t – you need that information.”

The head of the FCA, Nikhil Rathi, refused to rule out the possibility that drivers could lose out on compensation because of lost paperwork.

Mr Rathi told BBC Breakfast some contentious cases could be solved through the courts, but only if one or the other party involved had at least some details.

“We’re going to have to work through those issues in the consultation where one or the other party doesn’t have all the details. That is one of the challenges here.”

What will be classed as unfair?

The judgement left open the possibility of compensation claims for particularly large commissions which the Supreme Court said were unfair.

But Mr Hadrill said there was uncertainty over what might be considered an “unfair” agreement, as the Supreme Court said a number of factors had to be considered.

“I don’t think this scheme comes up with a solution to how you look at a whole range of factors [for loans]… and the FCA really needs to do that.”

He said the FCA’s compensation plan “looks like a one-size-fits-all scheme, but that isn’t what the court decided”.

The FCA’s Mr Rathi said the watchdog had to “make a judgement about that based on what the Supreme Court has given us and they have said different characteristics determine what’s unfair”.

These measures could be the level of commission, how it was disclosed, and the characteristics of a consumer.

The FCA estimates the total cost of such a scheme will cost between £9bn and £18bn. Separate analysis from RBC Capital Markets estimates the total cost could be £11.5bn.

The finance industry is expected to cover the full costs of any potential compensation scheme, including any administrative costs.

The FLA’s Mr Hadrill warned the “cost will have to be absorbed somewhere”.

“Ultimately, the more expensive lending becomes, the more expensive borrowing becomes for the consumer.”

The FCA has said it expects “a healthy finance market for new and used cars to continue notwithstanding any redress scheme we propose”.

The FCA has said that customers who are concerned that they may have been treated unfairly should contact their lender to make a complaint.

However, it told they do not need to use a claims management company (CMC) or a law firm to take part in any compensation scheme it sets up.

It warned that people signing up to a CMC might end up paying up to 30% in fees out of any compensation they could receive.

Worse-case scenario ‘swerved’

The decision by the Supreme Court to side with finance companies in two out of three crucial test cases on Friday, means the total bill for the mis-selling will be a lot less than some had feared.

Lenders – including some of the UK’s biggest banks and specialist motor finance firms – had already set aside more than £2bn for potential payouts ahead of the court ruling.

In a statement, Lloyds – which has already put aside nearly £1.2bn to cover potential costs – said “if there is any change to the provision it is unlikely to be material in the context of the Group”.

Russ Mould at AJ Bell said the “worst-case scenario, like a particularly ugly pothole, has been swerved”.

“This wasn’t a complete win for the industry, with lenders still potentially on the hook if the relationship with customers meets the threshold of being unfair.”

However, he added: “Essentially, while this issue could still cause some damage, it looks unlikely to be a repeat of the PPI scandal which blighted the banking industry in the 2010s.”