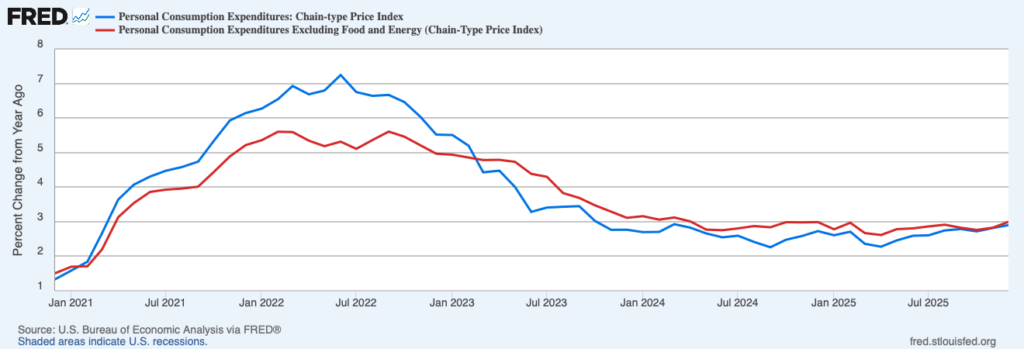

Delayed data confirms inflation remained well above target in December. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at an annualized rate of 4.4 percent in the last month of 2025. The PCEPI grew at an annualized rate of 3.1 percent over the prior three months and 2.9 percent over the prior year.

Core inflation, which excludes volatile food and energy prices, also remained elevated. Core PCEPI grew at a continuously compounding annual rate of 4.3 percent in December 2025. It grew at an annualized rate of 3.1 percent over the prior three months and 3.0 percent over the prior year.

The outsized price increases were widespread, if uneven. Goods prices grew at an annualized rate of 4.7 percent in December, and were up 1.7 percent year-over-year. The prices of durable goods grew at an annualized rate of 6.8 percent in December, whereas the prices of non-durable goods grew 3.6 percent. Services prices grew 4.2 percent in December. They grew 3.4 percent over the prior year.

Uncertainty Clouds the Policy Outlook

Stubbornly high inflation readings over the back half of 2025 led the Federal Open Market Committee to pause its rate cuts last month, with the federal funds rate target range held at 3.5 to 3.75 percent. FOMC members appear to be divided on whether — and, if so, when — to begin cutting rates again.

Back in December, the median FOMC member projected the federal funds rate would eventually settle around 3.0, albeit sometime after 2028. But the distribution of projections offered anything but certainty. Four FOMC members projected a longer run midpoint of the federal funds rate target range at or above 3.5 percent; five members projected a midpoint between 3.0 and 3.5 percent; five members projected a midpoint at 3.0 percent; and four members projected a midpoint below 3.0 percent.

The median FOMC member projected just one 25-basis-point cut this year. Here, too, FOMC members offered little certainty, however. Seven members projected the federal funds rate would remain at or above its current range this year. Four projected one 25-basis-point cut; four projected two cuts; and three projected more than two cuts.

Cause for Conflict

Why do the FOMC members’ assessments of the proper path for interest rates differ so much? They all have access to the same data, the same models, and an army of economists. Three factors stand out: data problems, policy shocks, and political pressure.

Last year’s government shutdown disrupted the usual flow of data, which has still not been totally restored. Today’s Personal Consumption Expenditures release is roughly one month behind schedule, and the Bureau of Economic Analysis does not expect to be back on track until the end of April. There are also concerns about data quality. When an underlying survey is not conducted, the effects of that missing data might linger on in ways that are difficult to discern. That sows doubt, prompting FOMC members already keen to take a wait-and-see approach to wait a little longer.

The last year has also been marked by significant policy changes. The Trump administration has ramped up immigration enforcement, reduced regulations, slashed government employment, rolled back green-energy efforts, and overhauled the tax code. It captured and removed former Venezuelan President Nicolás Maduro and has sent an armada to the Middle East, with potentially large and long-lasting implications for American energy costs. These policy changes affect productivity and, with it, estimates of potential output, maximum employment, and the longer run neutral rate of interest. But how and to what extent? The various contributors are so numerous and of uncertain magnitudes that it is anyone’s guess.

Fed officials are particularly focused on President Trump’s tariffs. At the post-meeting press conference in January, Fed Chair Jerome Powell said “our economy has pulled through pretty well […] given the very significant changes in trade policy.” That is partly because the tariffs ultimately imposed by the Trump administration were much lower than those initially announced and the retaliatory tariffs imposed by other countries were more limited than expected, he said. But it is also because “a good part of it hasn’t been passed through to consumers yet.” Powell explained how the Fed models the effects of tariffs:

At the beginning, it was very much of a forecast; now, it’s — every, every cycle that goes by, it becomes more informed by actual data. And we were — we — our forecasts were not far off. What changed was, as I think I said earlier, what changed was what was implemented was smaller than what was announced. In addition, we didn’t see retaliation internationally, and I think people did generally expect that because we saw that in the past. And that really mattered too. And then the other thing is the pass-through — didn’t know how fast that was going to be to consumers, didn’t know how much exporters would take, how much companies in the middle would take, and how much the consumer would take. And it turns out it’s a lot of companies in the middle — who, by the way, are pretty strongly committed to passing the rest of it through, which is one of the reasons why we need to keep our eye on inflation and not declare victory prematurely.

As Powell’s statement makes clear, there was a lot FOMC members didn’t know when tariffs were announced last year, some of which they still don’t know today. Today’s Supreme Court decision on Trump’s use of the International Emergency Economic Powers Act further complicates the analysis. Resolving all that uncertainty takes time — and data.

Finally, some FOMC members may be concerned with the perceived increase in political pressure on the Federal Reserve. President Trump has consistently called for lower interest rates over the last year. He is believed to have pressured then-Vice Chair for Supervision Michael Barr to step down. He attempted to fire Governor Lisa Cook. He nominated then-CEA Chair Stephen Miran to fill a vacancy at the Fed, presumably to push for lower interest rates. And his Department of Justice opened an investigation into Chair Powell. With these events in mind, some FOMC members may be reluctant to lower the federal funds rate target even if they think a cut is warranted by the data on the grounds that doing so would reduce the Fed’s credibility.

Implications for the March Meeting

FOMC members disagree about the proper path for the federal funds rate. Those disagreements stem from competing views on the many policy shocks realized over the last year and how best to deal with political pressure from the president. Data disruptions make it more difficult than usual to resolve those disagreements. The most recent PCEPI release illustrates the problem well: it arrives roughly a month behind schedule and may be distorted by the efforts taken to deal with missing surveys.

Given the context, it seems likely that the FOMC will continue to hold its federal funds rate steady in March. Indeed, the CME Group puts the odds of a March rate cut at just 4.0 percent.