Some variation of the phrase “the wealthy should pay their fair share of taxes” is frequently echoed by activists, pundits, politicians, and even some millionaires and billionaires (known as the “Proud to Pay More” group).[1],[2] This sentiment leads many to believe that the government can close budget deficits, reduce the debt, and fully fund entitlement programs by simply raising taxes on high-income earners.

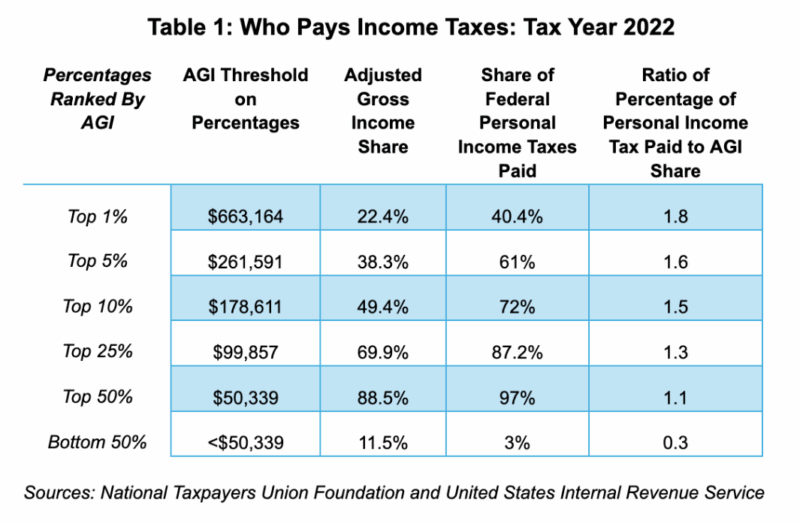

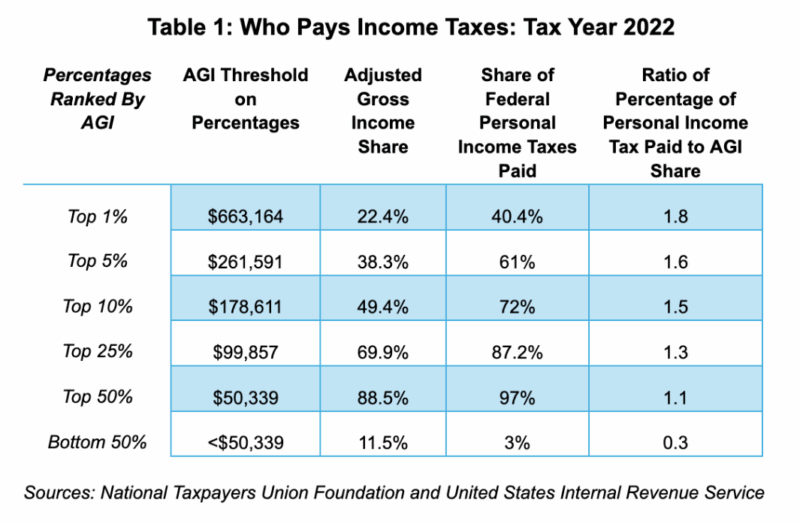

First, it’s important to look at who pays income taxes. Table 1 (recreated from Brady, 2024) illustrates income brackets by adjusted gross income (AGI) for taxes paid in tax year 2022 (the latest available data).[3]

Brady (2024) finds that the top 10 percent of filers earned nearly half of all income in 2022 but were responsible for 72 percent of all income taxes paid. Furthermore, evidence shows that the top 25 percent of filers have consistently paid at least 73 percent of all income taxes paid since 1980.[4]

Meanwhile, lower-income tax filers pay relatively little in personal income taxes themselves. Hodge (2021) shows that nearly one-third of all income tax filers (all in the bottom 50 percent) paid no income taxes thanks to the expansion of tax credits and deductions since 1980.[5] Hodge (2021) also cites the Congressional Budget Office (CBO) report “The Distribution of Household Income,” noting that in 2017 the lowest income earners receive more in direct federal benefits than they pay in income taxes while the top earners see the opposite effect.[6]

Below is an updated version of Hodge’s table using 2019 income groups:

Table 2: The Ratio of Government Transfers Received to Federal Taxes Paid

| Income Group | Transfer to Tax Ratio |

| Lowest Quintile | $68.17 |

| Second Quintile | $6.29 |

| Middle Quintile | $2.35 |

| Fourth Quintile | $1.05 |

| Highest Quintile | $0.24 |

| 81st to 90th Percentiles | $0.54 |

| 91st to 95th Percentiles | $0.33 |

| 96th to 99th Percentiles | $0.18 |

| Top 1 Percent | $0.04 |

Sources: Hodge (2021) and the United States Congressional Budget Office.

Notes: Dollar amounts are in 2024 dollars. This table uses 2019 data because it is the most recent non-pandemic year available as of July 2024.

Table 2 measures how much the average person in each income bracket receives for each dollar paid in taxes.[7] For each dollar paid in taxes, the average lowest quintile of income filers received $68.17 in federal transfers. Conversely, the average income filer in the top 1% received 4 cents in federal transfers for every tax dollar paid. There is clear evidence that the average tax burden increases as income increases. High-income earners pay a disproportionate share of the tax burden while receiving much less direct federal transfers (i.e. refundable tax credits and income assistance) than low- and middle-income earners.

It is also important to consider the economic impacts of such a tax system. Various literature reviews show that tax burdens and behavioral responses are complex.[8] High-income earners may decide to earn less, retire early, change the type of income (i.e. dividends or capital gains) or the timing of income to lower their tax burden. This may mean that low-income earners may shoulder a higher portion of the tax burden, but income transfer programs must also be considered. Income from transfer programs can also greatly offset any income tax burdens.[9] The time, talent, and resources used to balance offsetting tax burdens while remaining compliant with the tax code come at the cost of that time, talent, and resources being saved and invested elsewhere. High-income earners could have grown their businesses. Low-income earners could have used those funds to save for emergencies or improve their standard of living. Instead, it was spent navigating a complex and convoluted system of taxes and transfers.

Despite evidence to the contrary, there are still frequent cries that the rich are not paying their fair share in taxes. What constitutes a “fair share” is often incredibly vague, but almost always means “more than what the people wealthier than I am are currently paying in income taxes.”

Much of this resentment stems from the “Miser Fallacy.” Sometimes known as the “Scrooge Fallacy” or the “Smaug Fallacy,” this fallacy assumes that wealthy individuals hoard wealth.[10] They picture the likes of Scrooge McDuck swimming in a vault full of money, but this is not an accurate depiction. Even the stingiest high-income earners invest their money via the stock market or individual projects. If they were to save their money in a bank, the bank would then take the deposit to give access to capital in the form of business loans and mortgages. The wealthy saving and investing creates access to capital for all, allowing people to create and innovate, making everyone wealthier. On the connection between access to capital and savings, economist Ludwig von Mises stated,

“Capital is not a free gift of God or of nature. It is the outcome of a provident restriction of consumption on the part of man. It is created and increased by saving and maintained by the abstention from dissaving.”[11]

The perception that wealthy people are hoarding wealth is further bolstered by the appearance of income inequality. Hodge (2021) notes that the decline of traditional C Corporations[12] and the rise of pass-through businesses[13] that do not pay corporate income taxes have shifted the federal tax base.[14] Hodge (2021) states that this change in type of businesses impacts the appearance of income inequality because business income is now reported on personal income tax forms (IRS form 1040) instead of corporate income tax forms (IRS form 1120).[15] This gives the appearance of an explosion of personal income among the Top 1 percent of taxpayers. However, Hodge (2021) notes that with the rise in wage income of the Top 1 percent of taxpayers, there is an equivalent decline in business income and dividend income with the decline of the C Corporation.[16]

If high-income taxpayers do not believe that they are paying their fair share in taxes, they can always make a voluntary contribution to the United States government. Americans can contribute to the Treasury’s “Gifts to the United States” fund or, if they are particularly concerned about the national debt, they can contribute to the Treasury’s “Gifts to Reduce the Public Debt.”[17]

It is also worth noting the generosity of Americans across the income spectrum. Research from Paul Mueller notes that “the vast majority of Americans who give to charity receive no federal tax benefit from doing so.”[18] Additionally, America is one of the most charitable nations in the world. In closing, Mueller opines,

“Most Americans give generously without thought of return—even with a large welfare state and high taxes. There is something deeply admirable about this kind of generosity that gives without expecting any material benefit in return. Imagine how they would give if the welfare state were trimmed down and their taxes were lower. That’s what George W. Bush’s compassionate conservatism should have meant.”[19]

Despite high tax rates and expansive welfare systems, Americans (including the wealthy) still give to charity. The evidence is clear: the rich already pay more than their fair share—and anyone who still disagrees is ignoring the data.

Endnotes

[1] Galles, Gary. “Not a Very Virtuous Signal.” American Institute for Economic Research. February 2, 2024. Accessed July 25, 2024. https://www.aier.org/article/not-a-very-virtuous-virtue-signal/

[2] Hebert, David. “Want to Pay More Tax? You Can” American Institute for Economic Research. July 19, 2024. Accessed July 25, 2024. https://www.aier.org/article/want-to-pay-more-tax-you-can/

[3] Brady, Demian. “Who Pays Income Taxes: Tax Year 2022” National Taxpayers Union Foundation. February 13, 2024. Dec 2, 2024. https://www.ntu.org/library/doclib/2024/12/Who-pays-tax-year-2022.pdf

[4] “Who Pays Income Taxes (2013).” National Taxpayers Union Foundation. 2013. Accessed July 25, 2024. https://www.ntu.org/foundation/tax-page/who-pays-income-taxes-2013

[5] Hodge, Scott. “Testimony: Senate Budget Committee Hearing on the Progressivity of the U.S. Tax Code.” Tax Foundation. March 25, 2021. Accessed July 25, 2024. https://taxfoundation.org/research/all/federal/rich-pay-their-fair-share-of-taxes/#Burden

[6] “The Distribution of Household Income in 2020.” Congressional Budget Office. November 14, 2023. Accessed July 25, 2024. https://www.cbo.gov/publication/59509

[7] These transfers include social insurance (this includes Social Security, Medicare, unemployment insurance, and workers’ compensation) as well as means-tested transfers (specifically the Supplemental Nutrition Assistance Program, Medicaid and the Children’s Health Insurance Program, as well as Supplemental Security Income). Federal taxes paid include individual income taxes and payroll taxes.

[8] Congressional Budget Office. Recent Developments in the Literature on Labor Supply Elasticities. Washington, DC: U.S. Congressional Budget Office, October 2012. https://www.cbo.gov/publication/43675.

[9] Savidge, Thomas. The Work vs. Welfare Trade-Off: Revisited. Great Barrington, MA: American Institute for Economic Research, Feb 18, 2025. https://www.aier.org/article/the-work-vs-welfare-tradeoff-revisited/.

[10] Murray, Iain. “The Smaug Fallacy.” The Foundation for Economic Education. October 30, 2014. https://fee.org/articles/the-smaug-fallacy/

[11] Mises, Ludwig von. The Anti-Capitalistic Mentality. The Ludwig von Mises Institute. 2008 (1956). Accessed July 25, 2024. p. 84 https://mises.org/library/book/anti-capitalistic-mentality

[12] C Corporations (named for being in subchapter C in the Internal Revenue Code) is an independent legal entity owned by its shareholders. A C Corporation’s profits are taxed both as business income at the entity level and at the shareholder level when distributed as dividends or realized as the profit made from selling a share (known as capital gains).

[13] A pass-through business is a sole proprietorship, partnership, or S Corporation that is not subject to corporate income taxes. S Corporations (named for being in subchapter S in the Internal Revenue Code) is a business that chooses to pass business income and losses through its shareholders, who then pay personal income taxes on this income.

[14] Hodge, supra note 5.

[15] Id.

[16] Id.

[17] Hebert, supra note 2.

[18] Mueller, Paul. “What Scrooge Effect? Americans Keep Giving, Despite the Welfare State.” American Institute for Economic Research. 24 April 2025. https://thedailyeconomy.org/article/philanthropy-despite-the-state-americans-give-generously-even-without-tax-breaks/

[19] Id.