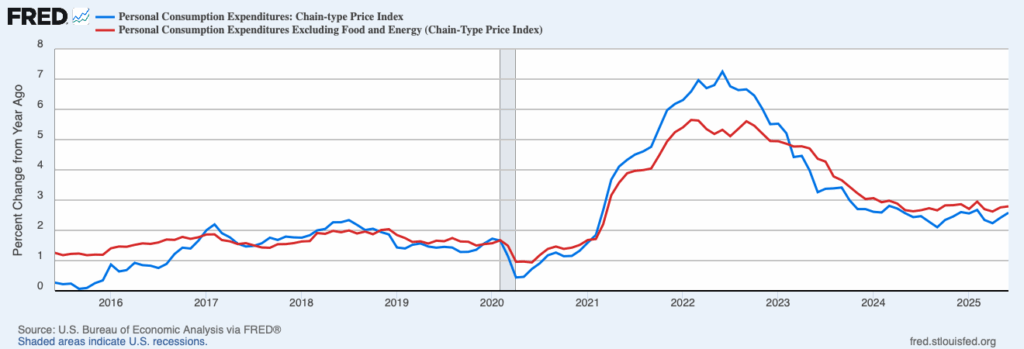

President Trump’s tariffs appear to be pushing prices higher. Inflation picked up in June, according to new data from the Bureau of Economic Analysis. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at an annualized rate of 3.4 percent last month, up from 2.0 percent in May. It has averaged 2.5 percent over the last three months and 2.6 percent over the last year.

Core inflation, which excludes volatile food and energy prices but also places more weight on housing services prices, was a bit lower. According to the BEA, core PCEPI grew 3.1 percent in June, up from 2.6 percent in the preceding month. It has averaged 2.6 percent over the last three months and 2.8 percent over the last year.

The uptick in inflation observed in June is largely due to newly-imposed tariffs by the Trump administration. Tariffs on foreign-produced goods get passed through to consumers, and enable domestic producers to charge higher prices for close substitutes. Consistent with this view, the BEA reports that the recent rise in prices was especially pronounced for goods.

Goods prices grew at an annualized rate of 4.8 percent in June, compared with 0.9 percent in the prior month. Durable goods prices, including prices for motor vehicles and parts, furnishings and durable household equipment, recreational goods and vehicles, as well as other durable goods, grew at an annualized rate of 5.7 percent (up from 0.3 percent in the prior month). Non-durable goods prices, including prices for food and beverages purchased for off-premises consumption, clothing and footwear, gasoline and other energy goods, as well as other non-durable goods, grew 4.3 percent (up from 1.2 percent).

Services prices, in contrast, grew just 2.8 percent (annualized) in June — only slightly higher than the 2.5 percent rise observed in May.

All else equal, higher tariffs cause a one-time rise in the level of prices and, hence, a temporary increase in the rate of inflation. Once tariffs have passed through, the rate of inflation will return to its longer run trend — though the level of prices will remain permanently elevated.

As my colleague Bryan Cutsinger has recently argued, the Federal Reserve should look through tariff-induced price hikes when setting monetary policy. That doesn’t mean, however, the Fed should leave its federal funds rate target unchanged:

[…] when productivity prospects dim — as they often do in the face of trade uncertainty: higher input costs, reduced access to more efficient foreign suppliers, and resource misallocation driven by protectionist policies — investment demand falls, dragging the neutral rate down with it.

In order for monetary policy to remain on track, the Fed must adjust its policy rate when the neutral rate changes. For example, if tariffs are pulling the neutral rate lower, then the appropriate course of action is for the Fed to cut its policy rate.

If the Fed leaves its federal funds rate target unchanged as tariffs pull the neutral rate down, monetary policy will passively tighten.

And yet, that is precisely what the Fed did at this week’s meeting. The Federal Open Market Committee voted 9-2 to hold the federal funds rate target in the 4.25 to 4.5 percent range.

Back in June, the median FOMC member projected the longer run federal funds rate at 3.0 percent. That suggests monetary policy was already quite restrictive. Hence, the Fed has not merely allowed monetary policy to tighten passively. It has done so from a position where monetary policy was already tight.

Prior to the meeting, Fed Governor Christopher Waller — one of two FOMC members to dissent from Wednesday’s decision — explained why he thought the FOMC should begin cutting rates. “While I sometimes hear the view that policy is only modestly restrictive,” he said, “this is not my definition of ‘modestly.’”

In fact, the distance that must be traveled to reach a neutral policy setting weighs heavily on my judgment that the time has come to resume moving in that direction. In June, a majority of FOMC participants believed it would be appropriate to reduce our policy rate at least two times in 2025, and there are four meetings left. I also believe — and I hope the case I have made is convincing — that the risks to the economy are weighted toward cutting sooner rather than later. If the slowing of economic and employment growth were to accelerate and warrant moving toward a more neutral setting more quickly, then waiting until September or even later in the year would risk us falling behind the curve of appropriate policy. However, if we cut our target range in July and subsequent employment and inflation data point toward fewer cuts, we would have the option of holding policy steady for one or more meetings.

Alas, a majority of voting FOMC members ignored Waller’s warning.

With the decision made, we must now hope the Committee comes around to Waller’s view by September — and that their decision in September is not too little, too late.