Tether, the issuer of USDT, is stockpiling Bitcoin in 2025. Is this a strategic move to protect against a USDT depeg? In 2021, USDC depegged and couldn’t restore the peg immediately because banks were closed.

The world’s largest multichain stablecoin by market cap—has been aggressively accumulating Bitcoin over the past few months.

Tether Stockpiling Bitcoin: Is This A Strategic Move?

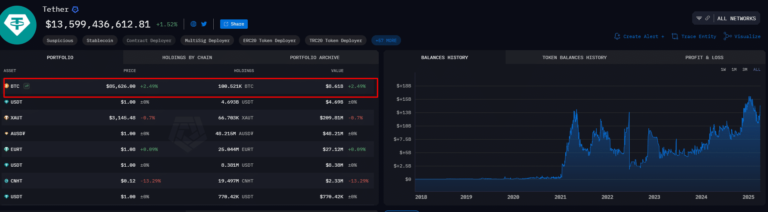

According to Arkham data, in Q1 2025, Tether, which has also invested in Bitcoin mining operations in Paraguay, bought 8,888 BTC, bringing its total holdings to 100,521 BTC.

(Source)

At this pace, Tether, a private firm whose shares are not traded on any exchange, is among the largest BTC holders, trailing Strategy (formerly MicroStrategy). However, it holds more BTC than Tesla.

This massive accumulation of BTC is why some on X believe the move is strategic and could significantly benefit the USDT issuer in case of a depeg.

Will Tether Sell Bitcoin If USDT Depegs?

In a post, an analyst said the decision to stockpile Bitcoin is “something underappreciated.”

Something underappreciated about Tether is that if USDT ever goes temporarily off-peg (like what happened with USDC), they have 7.8bn in BTC to spend instantly to maintain the peg

Whereas circle has all their money in banks, so repegging could take much longer (transfer delays)

— 0xngmi (@0xngmi) April 2, 2025

If USDT, which currently has a market cap of over $144 billion, depegs, Tether could quickly sell some of its BTC at spot rates and restore the peg without delays.

He cites the USDC depeg of March 2023, in which Circle waited two days for banks to reopen before parity was restored.

Unlike its competitor, the analyst thinks Tether could sell part of its Bitcoin holdings to restore a depeg without causing panic in the crypto trading community.

However, until a depeg event occurs—like after the Terra collapse in 2022 when USDT briefly fell to $0.96 or when FTX collapsed, forcing USDT to $0.971—it remains unknown whether Tether would sell Bitcoin as its first line of defense.

The Tether Bitcoin Reserve

Tether claims all USDT in circulation is backed by cash and other liquid equivalents, such as U.S. Treasury holdings. However, no official audit has confirmed the assets in its reserve. If anything, there is no discounting that they might be holding some of the best meme coins to invest in 2025.

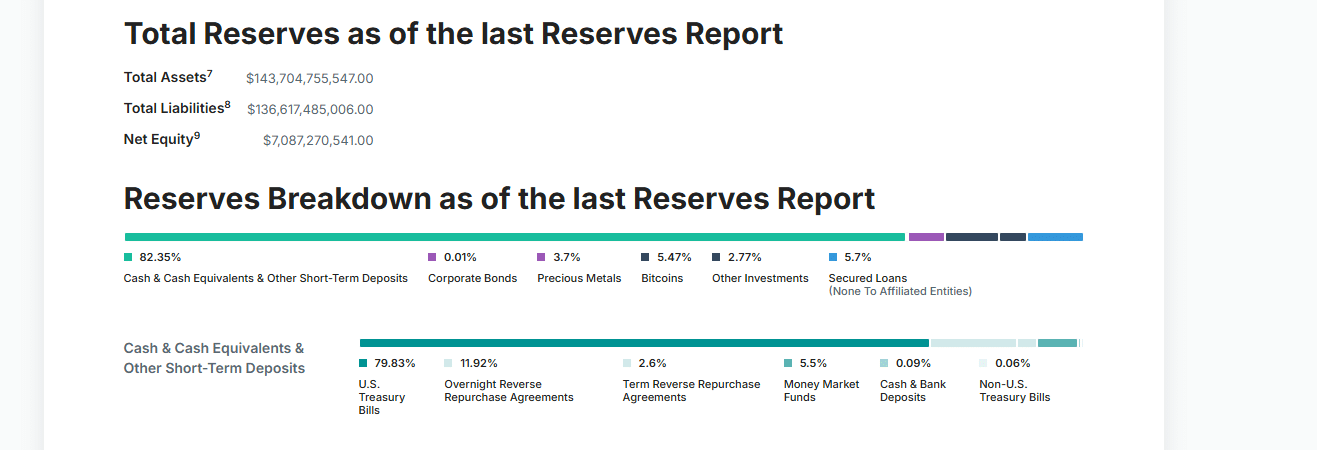

From the Tether Transparency page, the issuer holds 82.35% in cash and cash equivalents, including short-term U.S. Treasuries, as part of its reserve. Secured loans comprise 5.7% of the total reserve, while Bitcoin makes up 5.47%.

(Source)

For now, if USDT depegs, Tether might liquidate its Treasuries before unloading Bitcoin. This move will be because Treasuries are more liquid than BTC.

At the same time, selling Bitcoin in a crisis might destabilize the market further, exacerbating the problem and potentially causing more liquidity issues in the crypto market.

Is Bitcoin The Way?

Even so, Tether is committed to stacking BTC, which is relatively illiquid and more volatile than Treasuries. They are likely holding Bitcoin as a long-term investment rather than an emergency liquidity buffer, cementing its position as one of the best cryptos to buy.

It is also strategic. With the United States prioritizing the creation of proper stablecoin laws and establishing a crypto and Bitcoin reserve, Tether is aligning with key developments.

This approach will continue despite JPMorgan claiming that some of Tether’s reserves might include non-compliant assets like precious metals and corporate debt.

JPM analysts are salty because they don’t own Bitcoin.

— Paolo Ardoino

(@paoloardoino) February 13, 2025

In response, Tether dismissed these concerns, saying JP Morgan is “salty” and doesn’t own enough BTC.

DISCOVER: 9 High-Risk High-Reward Cryptos for 2025

Tether Bitcoin Strategy: Will It Sell BTC if USDT Depegs?

- Tether Bitcoin Holdings exceeds 100,000 BTC

- Will Tether sell Bitcoin if USDT depegs?

- USDT issuer reserves mainly consist of liquid treasuries and cash

- BTC is a strategic holding as crypto adoption picks up momentum in the U.S.

The post Is This The Real Reason Why Tether Is Buying Bitcoin? appeared first on 99Bitcoins.