If you’ve been around Bitcoin long enough, you know it moves in cycles, and the halving cycle is a big deal. It happens roughly every four years, halts the block reward, and has historically kicked off major price moves. But here’s the thing: it’s not just the halving event that matters; it’s what holders do before and after it.

Right now, long-term holders who’ve been holding their BTC for 3–5 years are quietly stacking. Data from Glassnode shows that after unloading more than 2 million BTC in two big waves earlier in this cycle, these holders are now deep in reaccumulation mode.

Across the 2023–25 cycle, Long-Term Holders have distributed over 2M $BTC in two distinct waves. Yet, each has been followed by strong re-accumulation, helping absorb the sell-side pressure. This cyclical balance may be stabilizing price action. pic.twitter.com/HAOZhG4q8o

— glassnode (@glassnode) March 31, 2025

Since mid-February, they’ve added around 363,000 BTC back to their wallets. That’s a strong signal: these aren’t traders looking for a quick flip. They’re playing the long game and appear to be positioning for what comes next.

Whales Intensify Accumulation Efforts And Swoop on Undervalued BTC USD

Meanwhile, the whales, wallets with over 1,000 BTC, have been busy too. At the beginning of April, Glassnode’s “accumulation score” for large whales hit a perfect 1.0, meaning they were going hard on buying for about two weeks straight.

Whales holding >10K $BTC briefly hit a perfect accumulation score (~1.0) at the turn of the month, reflecting intense 15-day buying. The score has since eased to ~0.65, still signaling steady accumulation.

Meanwhile, cohorts from <1 $BTC up to 100 $BTC have intensified their… https://t.co/cEo3F7Paid pic.twitter.com/7udA7G8nSM— glassnode (@glassnode) April 7, 2025

It’s cooled slightly since then (currently around 0.65), but that still reflects aggressive accumulation compared to the average.

This behavior often signals a quiet transfer of coins from short-term holders or retail investors to longer-term, deep-pocketed players. Whether they’re preparing for a bull run or just hedging against macro uncertainty, it’s clear the big players are treating this price zone like a buying opportunity.

Short-Term Holders Show Caution Post Bitcoin Halving

Now flip the lens to the other side of the spectrum: short-term holders, wallets that have held BTC for a few weeks to six months. These folks are acting more skittish. Historically, this group sells every 8–12 months in waves. Their spending behavior is currently near the low end of the range. Translation? They’re holding… for now.

But that’s a double-edged sword. If the price drops further, these holders may panic and sell, fueling a potential downside. So, sitting still today, they could become the first domino to fall in a correction scenario.

Market Sentiment Reflects Underlying Uncertainty

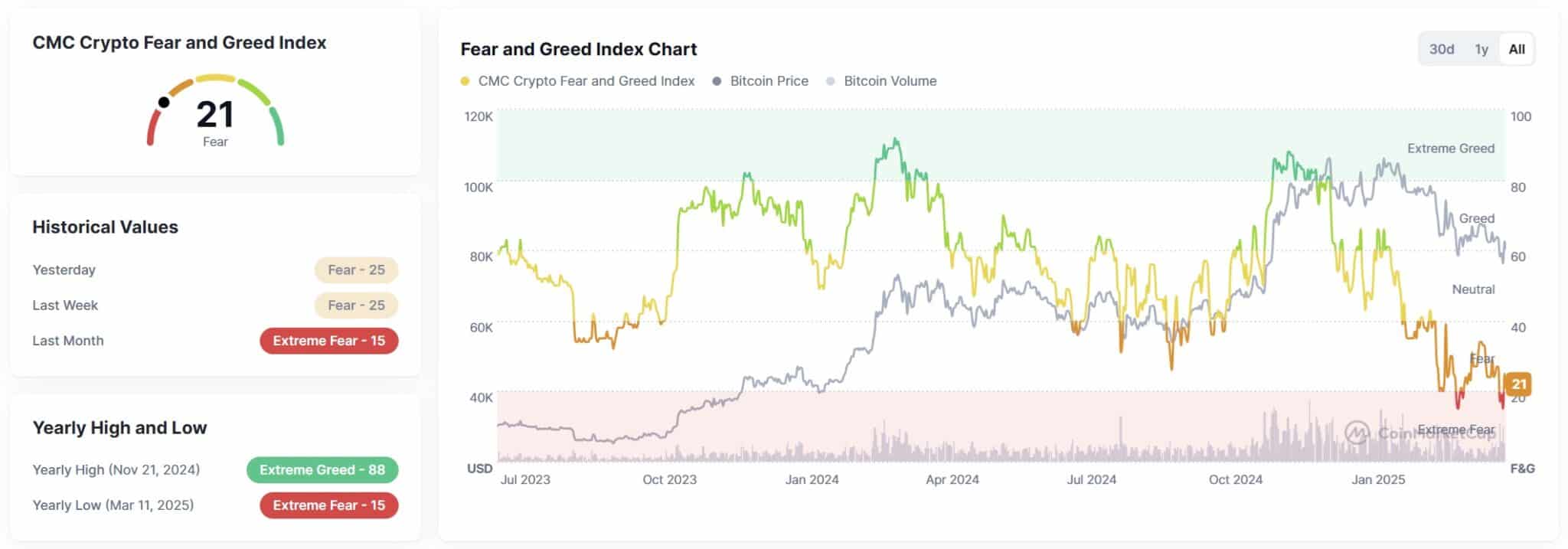

And then there’s sentiment, always the X factor in crypto. The CoinMarketCap Fear & Greed Index has been sitting in “Fear” and “Extreme Fear” territory for weeks. The general investor mood hasn’t caught up, even with accumulation happening behind the scenes.

Whether it’s inflation fears, macro tension, or post-halving fatigue, the market isn’t convinced of where we’re headed next. And that kind of mood tends to keep volatility high and conviction low.

Looking Ahead: Potential for Continued Growth

So, where does this leave us? Long-term holders and whales are quietly accumulating, often setting the stage for stronger price action. But we’re still in a transitional zone until sentiment shifts and short-term holders stop flinching at every red candle.

Call it the calm before the next phase. The halving is done — now the waiting (and watching) begins.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Long-term Bitcoin holders have resumed accumulation, adding over 363,000 BTC since mid-February after earlier sell-offs.

- Whales with 1,000+ BTC showed peak accumulation in early April, signaling confidence in the current price zone.

- Short-term holders are showing caution, with low spending activity—but could trigger downside if panic selling starts.

- Market sentiment remains in “Fear” territory, suggesting investors are uncertain despite strong on-chain accumulation trends.

- With halving complete and accumulation rising, the stage may be set for the next bull phase—once sentiment and momentum align.

The post Post-Halving Bitcoin: Long-Term Holders Are Loading Up Again – Is the Next Rally Loading? appeared first on 99Bitcoins.