Bitcoin Magazine

These 3 Signals Statistically Predict Bitcoin’s Next Big Move

For much of this cycle, Global Liquidity has been one of the most accurate indicators for anticipating Bitcoin’s price action. The connection between money supply expansion and risk-asset growth has been well established, and Bitcoin has followed that script remarkably closely. Yet recently, we’ve been paying close attention to a couple of other data points that have been statistically even more accurate in predicting where Bitcoin is headed next. Together, these metrics help paint a clearer picture of whether Bitcoin’s recent stagnation represents a short-term pause or the beginning of a longer consolidation phase.

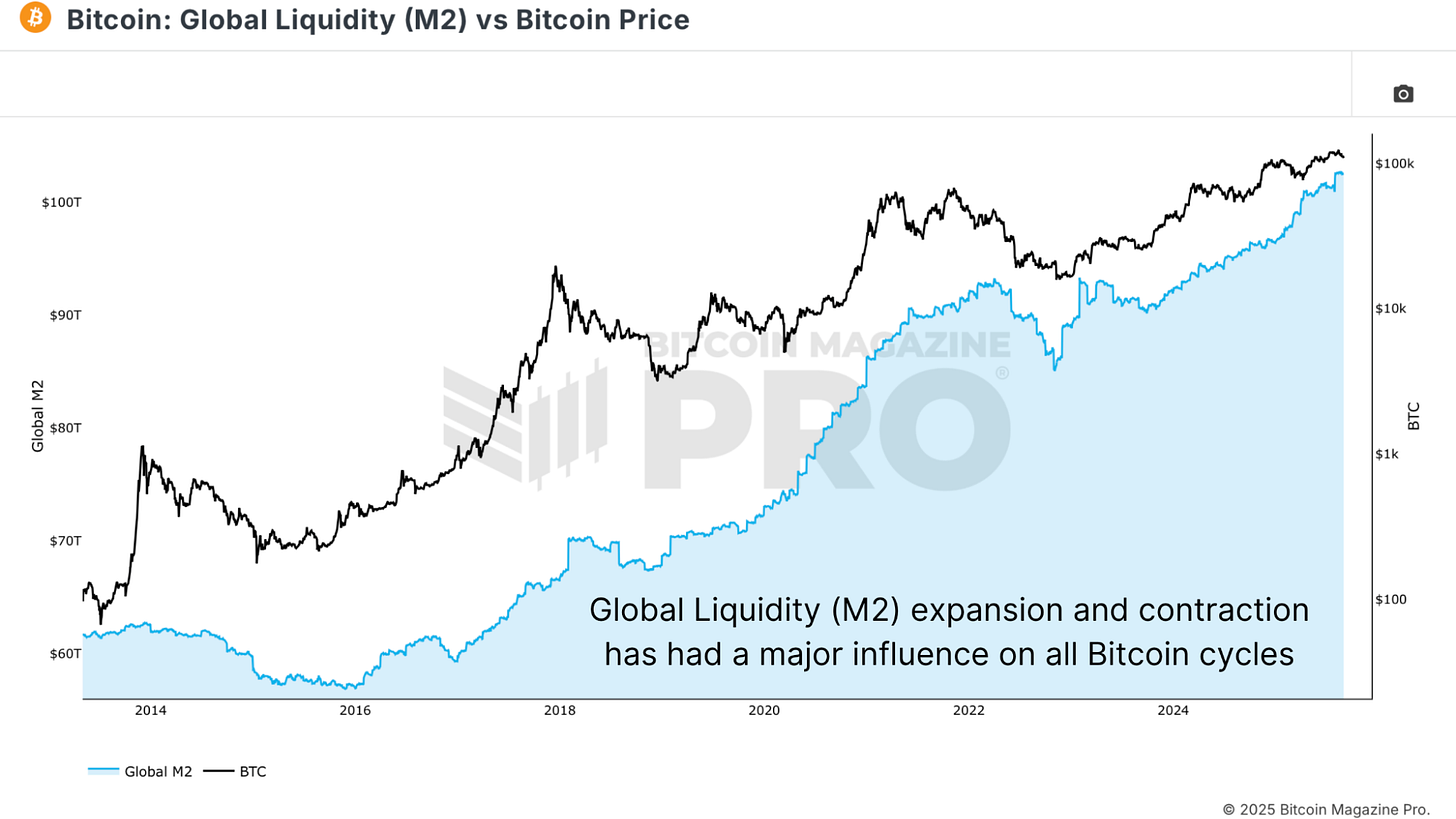

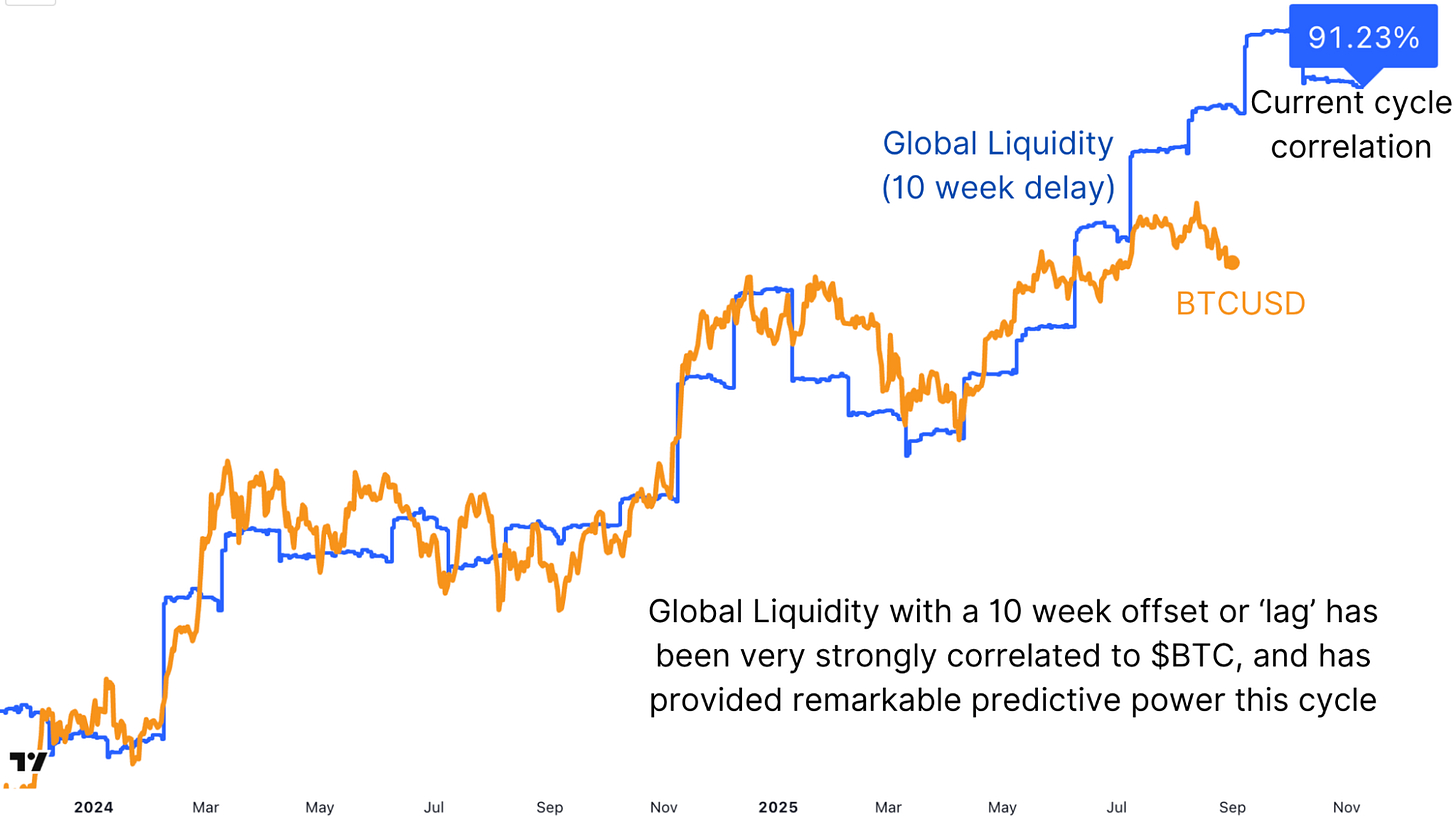

Bitcoin Price Trends Driven by Global Liquidity Shifts

The relationship between Global Liquidity, particularly M2 money supply, and Bitcoin’s price is hard to ignore. When liquidity expands, Bitcoin tends to rally; when it contracts, Bitcoin struggles.

Measured across this current cycle, the correlation stands at an impressive 88.44%. Adding a 70-day offset pushes that correlation even higher to 91.23%, meaning liquidity changes often precede Bitcoin’s moves by just over two months. This framework has proven remarkably accurate in capturing the broad trend, with cycle dips aligning with Global Liquidity tightening, and the subsequent recoveries mirroring renewed expansion.

Still, there has been a notable divergence recently. Liquidity continues to rise, signaling support for higher Bitcoin prices, yet Bitcoin itself has stalled after making new all-time highs. This divergence is worth monitoring, but it doesn’t invalidate the broader relationship. In fact, it may suggest that Bitcoin is simply lagging behind liquidity conditions, as it has done at other points in the cycle.

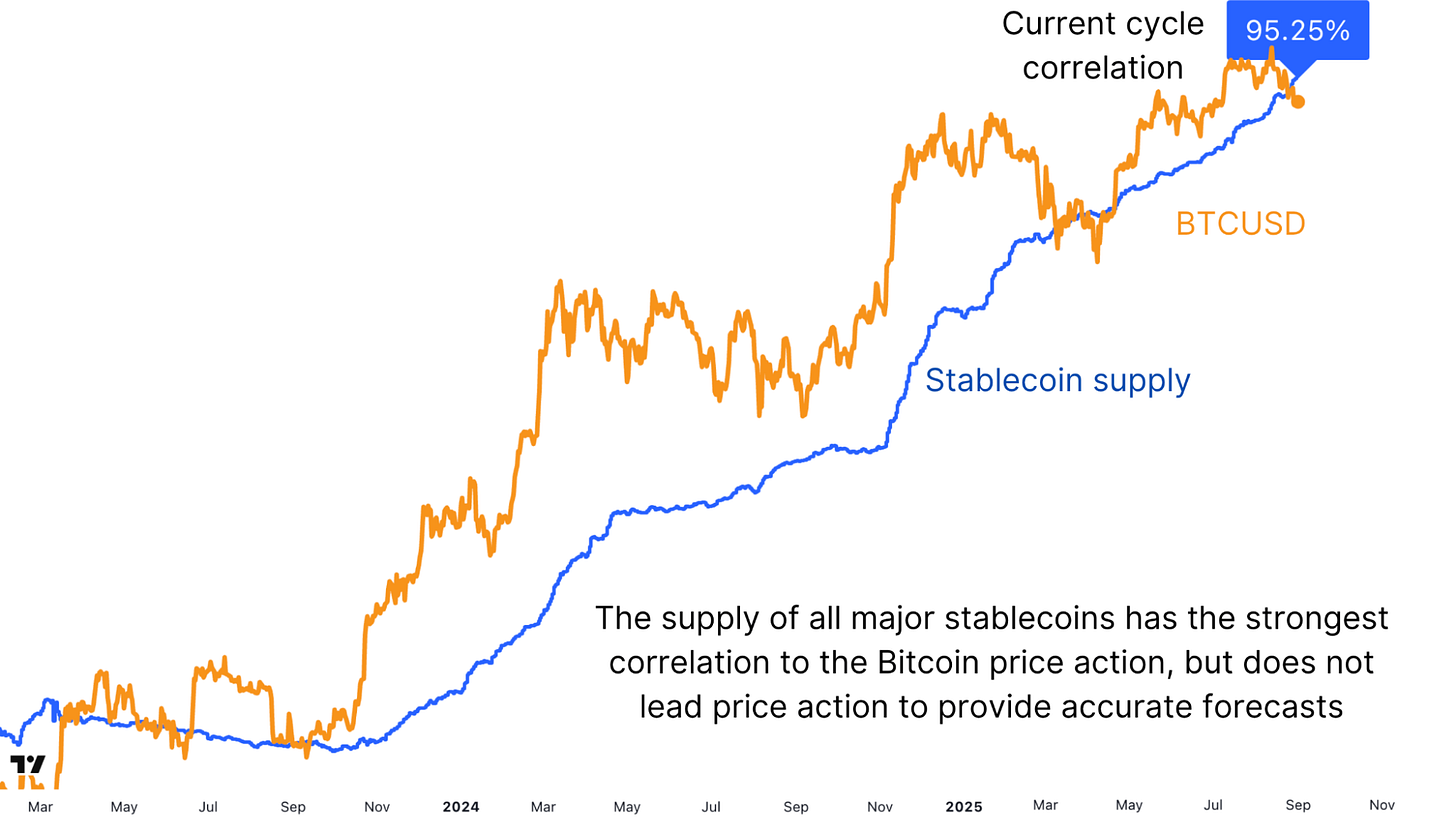

Stablecoin Supply Signaling Bitcoin Market Surges

While Global Liquidity reflects the broader macro environment, stablecoin supply provides a more direct view of capital ready to enter digital assets. When USDT, USDC, and other stablecoins are minted in large amounts, this represents “dry powder” waiting to rotate into Bitcoin, and eventually more speculative altcoins. Surprisingly, the correlation here is even stronger than M2 at 95.24% without any offset. Every major inflow of stablecoin liquidity has preceded or accompanied a surge in Bitcoin’s price.

What makes this metric powerful is its specificity. Unlike Global Liquidity, which covers the entire financial system, stablecoin growth is crypto-native. It represents direct potential demand within this market. Yet here, too, we are seeing a divergence. Stablecoin supply has been expanding aggressively, making new highs, while Bitcoin has consolidated. Historically, such divergences don’t last long, as this capital eventually seeks returns and flows into risk assets. Whether this suggests imminent upside or a slower rotation remains to be seen, but the strength of the correlation makes it one of the most important metrics to track in the short to medium term.

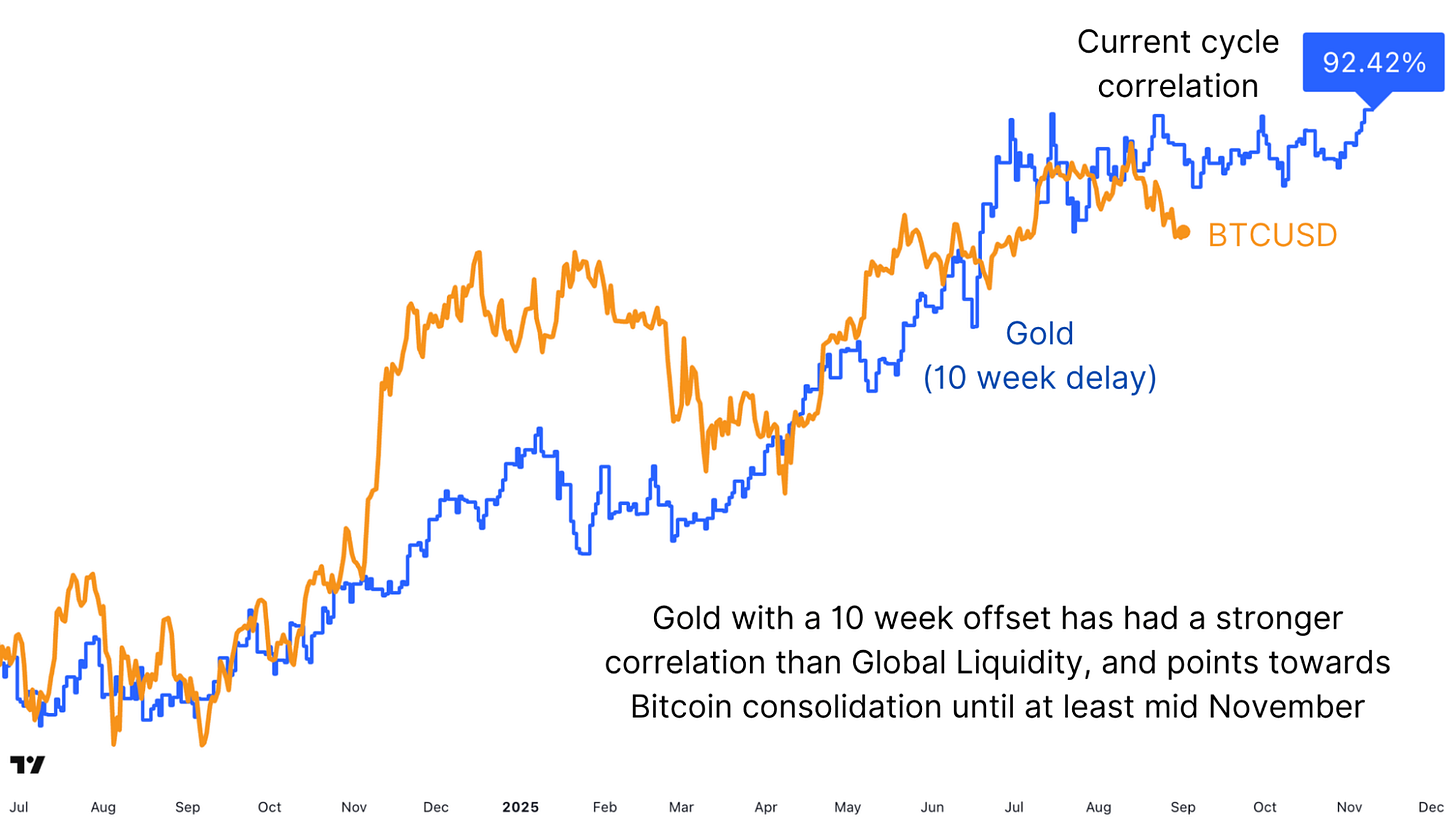

Bitcoin Predictive Power of Gold’s High-Correlation Lag

At first glance, Bitcoin and Gold don’t share a consistently strong correlation. Their relationship is choppy, sometimes moving together, other times diverging. However, when applying the same 10-week delay we applied to the Global Liquidity data, a clearer picture emerges. Across this cycle, Gold with a 70-day offset shows a 92.42% correlation with Bitcoin, higher than Global M2 itself.

The alignment has been striking. Both assets bottomed at nearly the same time, and since then, their major rallies and consolidations have followed similar trajectories. More recently, Gold has been locked in a prolonged consolidation phase, and Bitcoin appears to be mirroring this with its own choppy sideways action. If this correlation holds, Bitcoin may remain range-bound until at least mid-November, echoing Gold’s stagnant behavior. Yet with Gold now looking technically strong and primed for new all-time highs, Bitcoin could soon follow if the “Digital Gold” narrative reasserts itself.

Bitcoin’s Next Move Forecasted by Key Market Metrics

Taken together, these three metrics, Global Liquidity, stablecoin supply, and Gold, provide a powerful framework for forecasting Bitcoin’s next moves. Global M2 has remained a reliable macro anchor, especially with a 10-week lag. Stablecoin growth offers the clearest and most direct signal of incoming crypto demand, and its accelerating expansion suggests mounting pressure for higher prices. Meanwhile, Gold’s delayed correlation provides a surprising but valuable predictive lens, pointing toward a period of consolidation before a potential breakout later in the coming weeks.

In the short term, this confluence of signals suggests that Bitcoin may continue to chop sideways, mirroring Gold’s stagnation even as liquidity expands in the background. But if Gold breaks to new highs and stablecoin issuance continues at its current pace, Bitcoin could be setting up for a powerful end-of-year rally. For now, patience is key, but the data suggests that the underlying conditions remain favorable for Bitcoin’s long-term trajectory.

Loved this deep dive into bitcoin price dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

For more deep-dive research, technical indicators, real-time market alerts, and access to expert analysis, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post These 3 Signals Statistically Predict Bitcoin’s Next Big Move first appeared on Bitcoin Magazine and is written by Matt Crosby.