Social Security is drifting toward a cliff, and Congress keeps pretending the shortfall will fix itself. It won’t.

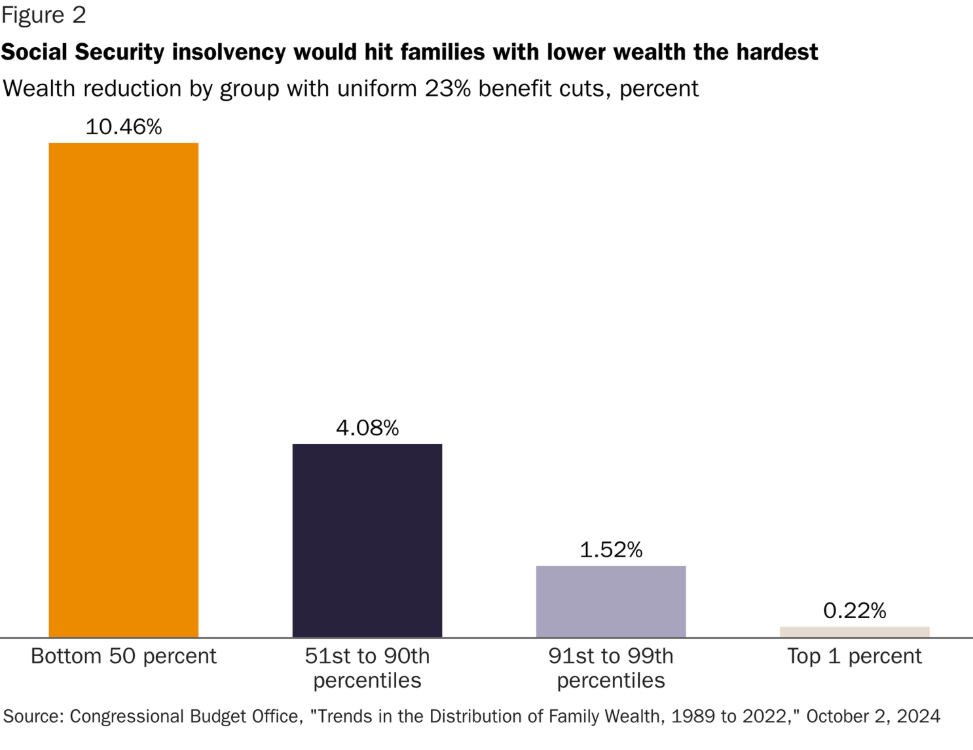

Absent reform, benefits will be cut across the board by roughly 23 percent within six years. That outcome would harm retirees who depend on Social Security the most — while barely affecting the living standards of those who do not need financial support in old age.

There is a better option: reduce distributions to the wealthiest retirees, preserving them for those most dependent on benefits.

This should not be a radical idea. Government income transfers should be targeted to those who need financial support — not used to subsidize consumption among well-off seniors at the expense of younger working Americans. This approach is grounded in what Social Security was meant to do in the first place: “give some measure of protection to the average citizen and to his family against…poverty-ridden old age,” in the words of Franklin D. Roosevelt.

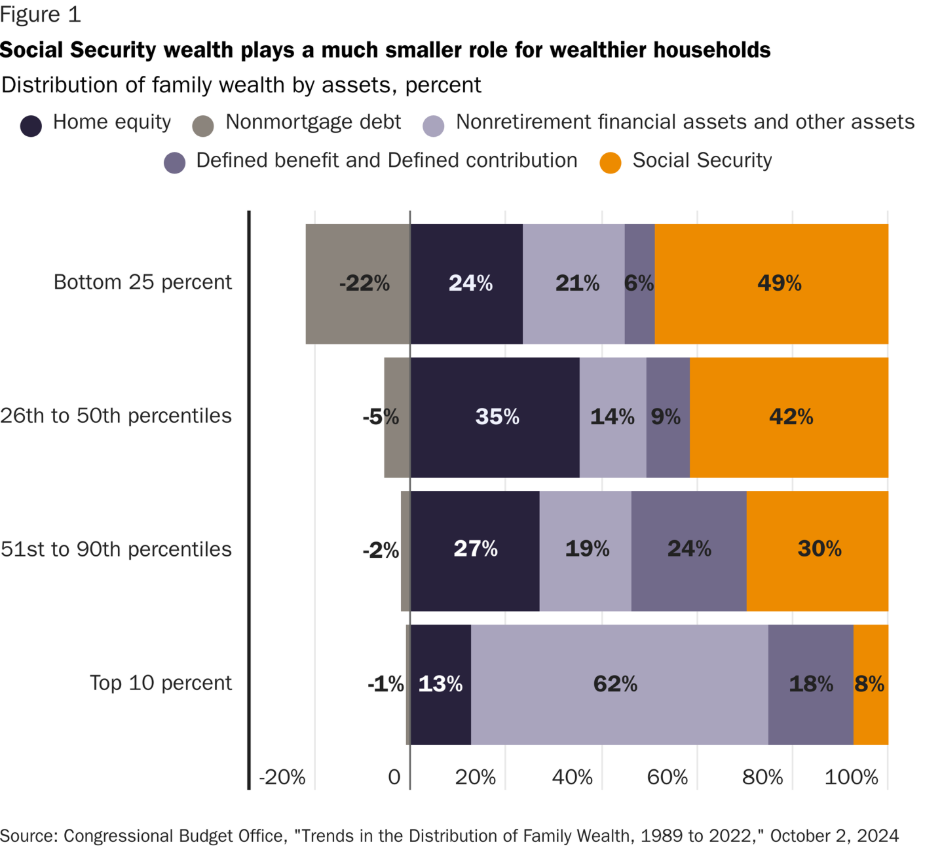

A report by the Congressional Budget Office, titled “Trends in the Distribution of Family Wealth, 1989 to 2022,” elucidates the role that Social Security plays in total household wealth. By counting not just financial assets and home equity, but also the present value of future Social Security benefits, it becomes clear that Social Security represents a substantial share of total resources for lower-wealth families and only a marginal share for wealthy households.

For families in the bottom quarter of the wealth distribution, accrued Social Security benefits account for about half of everything they own. Social Security represents only about eight percent of total assets for the top 10 percent, compared to holdings in financial assets, real estate, and business equity (see Figure 1). Yet under current law, wealthy retirees who claim at age 70 can still receive annual Social Security benefits exceeding $62,000 — roughly four times the poverty threshold for seniors.

This is an upside-down safety net. When automatic benefit cuts kick in in 2032, the retirees who rely most on Social Security will be hurt the most, while wealthy households will scarcely notice the change.

According to the CBO, that uniform 23-percent cut would reduce the total wealth of families in the bottom half of the distribution by more than 10 percent. For the top one percent, the hit would be barely noticeable: about two-tenths of one percent (see Figure 2).

This outcome is not inevitable; Congress can target benefit reductions where they are most easily absorbed.

Opponents of top-end benefit reductions argue that Social Security is an earned benefit, not welfare, and that cutting benefits for high earners violates that principle. They are right about one thing: workers pay payroll taxes with the expectation of receiving benefits. But that expectation was never a guarantee of open-ended, inflation-beating returns — especially for retirees who already enjoy substantial private wealth.

Social Security, if it is to exist at all, should focus on preventing old-age poverty, not provide wealthy retirees with an ever-growing worker-funded annuity layered on top of substantial private savings. When benefits grow faster than inflation and flow disproportionately to those who don’t need them, the program drifts away from its stated purpose and becomes increasingly difficult to justify.

The solution is not higher payroll taxes. Eliminating the payroll tax cap would push marginal tax rates above 60 percent in some states, reducing work and innovation, while still failing to target benefits where they matter most. Increasing payroll taxes for all workers would deprive younger working families of resources with which to grow their fortunes and build their own futures.

Nor is the solution more borrowing. Social Security is already projected to add trillions to federal deficits over the next decade. Borrowing to preserve full benefits for wealthy retirees is fiscally reckless and economically unnecessary.

The sensible path forward is targeted benefit restraint.

That means:

- Slowing the growth of initial benefits for higher earners by adjusting the benefit formula and indexing those initial benefits to prices rather than wages.

- Using a more accurate measure of inflation for cost-of-living adjustments for ongoing benefits, and phasing out adjustments entirely for high-income retirees.

- Adjusting retirement ages to reflect longer life expectancy, with protections for workers who truly cannot work longer — which is the aim of the disability component of Social Security.

In practice, these changes amount to a gradual shift away from an earnings-related benefit and toward a flat, anti-poverty payment. If Social Security is going to persist, its role should be limited to what market earnings and private savings cannot reliably provide. Every step that trims excessive benefits at the top moves the program closer to that defensible boundary.

Congress should act to prevent across-the-board benefit cuts, without more deeply indebting younger generations, nor sucking up more resources from working Americans. Instead, lawmakers should focus reforms where they do the least harm and the most good — by trimming earned benefits at the top to secure endangered benefits for those at the bottom.

It may not be “fair,” but it’s the only plausible path forward. The goal of reform should not be to preserve Social Security in its current form, but to prevent the worst outcomes. Preserving benefits for those who depend on the program, while slowing benefit growth for those who do not, is the only way to reduce Social Security’s role as a reverse transfer from younger workers to wealthy retirees who do not need the support.