U.S. economic recovery slows; USD loses steam for the second consecutive week.

The United States Bureau of Labor Statistics reported last week that non-farm payrolls stood at 245,000, which is lower than expectations of 469,000 and last month’s 610,000. Average hourly earnings climbed by 4.4 percent in November (year-on-year) while gaining 0.3 percent in monthly terms. The unemployment rate was at 6.7 percent in November, an improvement from the previous month’s 6.9 percent and surpassing forecasts of 6.8 percent.

The sharp deceleration of employment suggests that the US economic recovery may take longer than previously expected. Some analysts found the report disappointing and interpreted it as a sign of economic trouble.

The COVID-19 situation itself does not support optimistic narratives, as cases keep surging. So far, 14,983,425 coronavirus cases have been reported in the United States, as well as 287,825 deaths, making it the most affected country in the world. Hospitalization and deaths recently hit record levels, which may be linked to the recent Thanksgiving celebrations that were held across the country.

Paradoxically, this news was taken positively by the stock markets, as US shares closed in mainly positive territory on Friday. The Dow Jones Industrial Average gained 0.83 percent during the session, closing at the 30,218.26 level, followed by the S&P 500 which gained 0.88 percent during the session and closed at the 3,699.12 level. The NASDAQ 100, which closed at the 12,528.48 level, gained 0.49 percent during the session.

Attention is on the Federal Reserve, which is now expected to boost its bond-purchasing program in an attempt to stimulate the US economy. This idea was somewhat confirmed by Federal Reserve Chairman Jerome Powell’s recent comments about the path that the bank is taking in the near future.

“We are going to keep our rates low and keep our tools working until we feel like we really are very clearly past the danger that is presented to the economy from the pandemic,” he said.

Additional fiscal stimulus is also a possibility. Though negotiations on a new stimulus package are yet to resume, new proposals are now being considered in the U.S. Senate.

Economic Calendar

The markets received important and relevant data about the current state of the US economy.

Among the most relevant reports was the Chicago Purchasing Managers’ Index for November, which signaled an expansion of the business sector across the states of Illinois, Michigan and Indiana. The reading stood at 58.2, below the previous month’s 61.1 and lower than expectations of 59. The Pending Home Sales Index dropped by 1.1 percent, below predictions of a 1 percent surge but better than the previous month’s figure.

Markit Economics reported the Manufacturing PMI on Tuesday, which showed an expansion of the sector but remained below expectations of a steeper expansion and the previous month’s 59.3.

November’s employment change figure was reported on Wednesday, which stood at 307,000, lower than expectations and the previous month’s figure.

The Service PMI was released on Thursday, signaling (again) a slower expansion of the sector with a final reading of 55.9. Expectations were of 56, and the previous month’s reading stood at 56.6.

US Dollar Loses Steam for the Second Consecutive Week

The US Dollar Index, which measures the greenback’s performance against a bundle of its main competitors, lost ground for the second consecutive week and dropped by 1.19 percent. The dollar went down by 0.65 percent last week, which resulted in a drop of 2.31 percent for November.

Many analysts attribute this weakness to the fact that investors are currently rushing towards riskier assets, now that the hopes for a vaccine are high.

Some of these analysts expect this weakness to persist through 2020, as they expect additional monetary stimulus. Others predict that the dollar’s and equity markets’ performance-inverse relationship will remain relevant in the near future.

“We forecast another 5-10% dollar decline through 2021 as the Fed allows the U.S. economy to run hot,” said analysts at ING.

US Economic Data Worse Than Expected

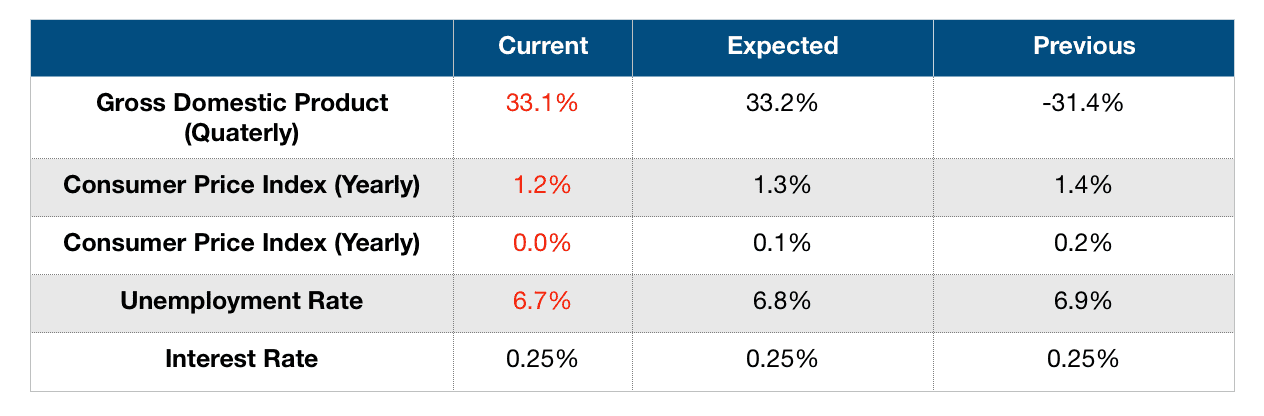

In its last report, the Bureau of Economic Analysis reported that the gross domestic product rose by 33.1 percent in the third quarter (quarter-on-quarter), below expectations of 33.2 percent and after decreasing by 31.4 percent in the second quarter.

Inflation has been low, at least compared to the Federal Reserve’s inflation target. In yearly terms, the Consumer Price Index missed analysts’ expectations, climbing by 1.2 percent in November after an increase of 1.4 percent in the previous month. In monthly terms, the CPI stood at 0 percent, below forecasts of a 0.1 percent increase and lower than October’s 0.2 percent.

As mentioned, the unemployment data turned out to be disappointing, standing at 6.7 percent in November. While this did not meet expectations, it was lower than the previous month’s 6.9 percent.

At the moment, cash rates remain at 0.25 percent. The Federal Reserve’s upcoming cash rate announcement is set to take place on December 16.

Upcoming Events

-

On Tuesday, the Energy Information Administration will be releasing its short-term energy outlook.

-

On Wednesday, the US Bureau of Labor Statistics will be publishing its JOLTs Job Openings report.

-

Also on Wednesday, the Energy Information Administration will be reporting about the Crude Oil inventories level.

-

Core CPI data for November will be reported on Thursday, as well as initial jobless claims.

-

On Friday, the U.S Bureau of Labor Statistics will be releasing the Producer Price Index.