As widely expected, the Bank of Canada (BOC) kept interest rates unchanged at 2.75% in July, marking its third consecutive hold as policymakers grapple with persistent U.S. trade uncertainty and mixed domestic economic signals.

This decision came as Governor Tiff Macklem acknowledged that tariffs are causing permanent economic damage, stating that while growth will resume, “it’ll be on a permanently lower path.”

Key Points from BOC’s Event:

- Rate unchanged: Overnight rate held at 2.75%, with Bank Rate at 3% and deposit rate at 2.70%

- Trade uncertainty persists: U.S. tariffs “still too unpredictable” to provide single economic forecast

- Economic contraction: Q2 GDP estimated to have contracted 1.5% after Q1’s 2.2% growth driven by export pull-forward

- Inflation pressures mixed: Headline CPI at 1.9% but underlying inflation climbed to roughly 2.5%

- Dovish tilt: BOC explicitly states rate cuts may be needed if economy weakens further

Link to the official BOC July monetary policy statement

In his presser, Macklem revealed there was “clear consensus” to hold rates steady, but acknowledged the Governing Council had “more diversity of views” regarding future policy direction. He emphasized the BOC must proceed carefully given the “unusual amount of uncertainty,” being less forward-looking than usual, while ready to respond to new information.

The BOC head honcho stressed that “we will support economic growth while ensuring inflation remains well controlled,” warning that the bank won’t let “a tariff problem become an inflation problem.”

He noted that some factors causing the recent uptick in underlying inflation should unwind, citing the appreciated Canadian dollar and moderated wage growth.

Link to BOC July monetary policy press conference

For the second consecutive quarter, the BOC abandoned traditional forecasts, instead presenting three scenarios based on tariff outcomes.

- In the current tariff scenario (based on tariffs as of July 27), GDP grows about 1% in H2 2025 before gradually picking up to 1.8% by 2027, leaving economic activity permanently lower. Inflation hovers around 2% as tariff-driven price increases are offset by excess supply and a stronger Canadian dollar.

- The de-escalation scenario sees GDP growth rebounding to around 2% in late 2025 if tariffs are rolled back, with inflation falling below 2% through 2026.

- In contrast, the escalation scenario warns of a three-quarter recession with GDP 1.25% lower by 2027 and inflation jumping above 2.5% in 2026 before sliding back.

The report highlighted that Canada’s economy is being “whipsawed by U.S. trade policy,” with the output gap widening to -1.5% to -0.5% in Q2. Export disruptions have concentrated job losses in trade-intensive sectors, though employment has held up elsewhere, keeping unemployment at 6.9%.

Link to BOC July Monetary Policy Report

Market Reactions

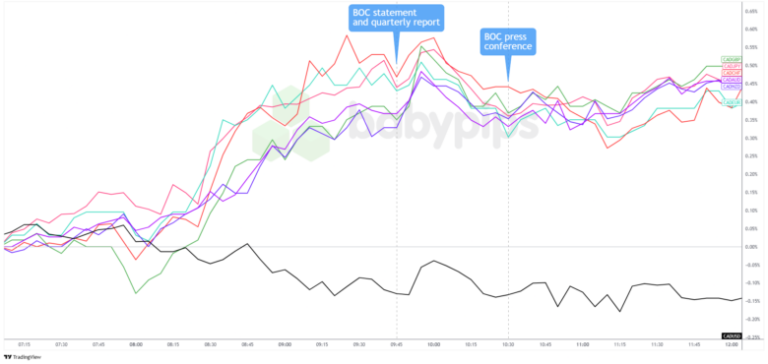

Canadian Dollar vs. Major Currencies: 5-min

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar, which had climbed alongside the U.S. dollar after the upbeat GDP report, dipped on the BOC’s decision to hold. Traders likely saw that coming but were hoping for firmer forward guidance.

The Loonie briefly bounced, then slipped again as markets digested the bank’s cautiously dovish tone. The statement’s reference to a possible rate cut and easing inflation pressures stood out, while some traders likely squared positions ahead of the FOMC.

Governor Macklem’s press conference didn’t bring much clarity. Markets weighed the openness to cuts against recession risks and the mention of divided views within the council. CAD lost ground to the euro and franc but held steady elsewhere.

By day’s end, the Loonie acted as a countercurrency during the Fed event and finished higher against most majors, aside from the U.S. dollar.

The muted reaction suggests the hold was already priced in. Odds of another pause in September sit near 81%, with traders waiting for clearer signals on the tariff outlook before making their next move.