- The AUD/USD weekly forecast stays bullish amid dollar weakness.

- Fed repricing with higher odds of a rate cut and soft macro data weakened the greenback.

- Commodity prices and China-linked risk flows supported the Aussie.

The AUD/USD price closed the week near mid-0.6500, marking 1.45% gains last week, led by broad US dollar weakness and firm commodity sentiment.

What happened with AUD/USD last week

The dominant theme was rapid Fed repricing last week. Markets ramped up wagers that the Federal Reserve will begin easing in its December meeting, weighing on the US yields and denting the US dollar, which acted as a headwind for the Aussie. According to the CME FedWatch Tool, the probability of a 25-bps rate cut by the Fed is now near 87%.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Commodity prices and China-linked risk flows also supported this trend. Iron ore and base metal stability supported the term structure for the Aussie, while Asian equities remained resilient, maintaining a constructive risk appetite.

On the domestic front, Australian data remained mixed, with consumer spending showing strain, while the labor market remained comparatively resilient, leaving the RBA in a patient and data-dependent stance. The RBA’s neutral tone capped the Aussie’s strength. The uptick in the pair was mainly attributed to the softness of the greenback rather than Australia’s domestic macroeconomic pivot.

The US data, including Durable Goods Orders, Chicago PMI, and Retail Sales, showed weakness, while Fed members also left dovish remarks, cementing the odds of aggressive easing in 2026 as well. Liquidity remained thin into the US Thanksgiving holiday, and the CME outage triggered intraday volatility.

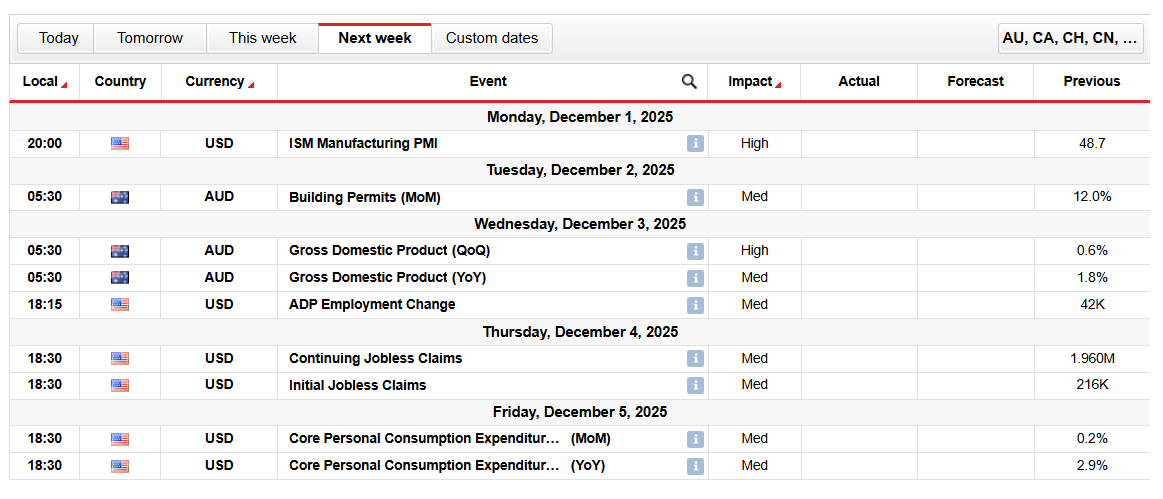

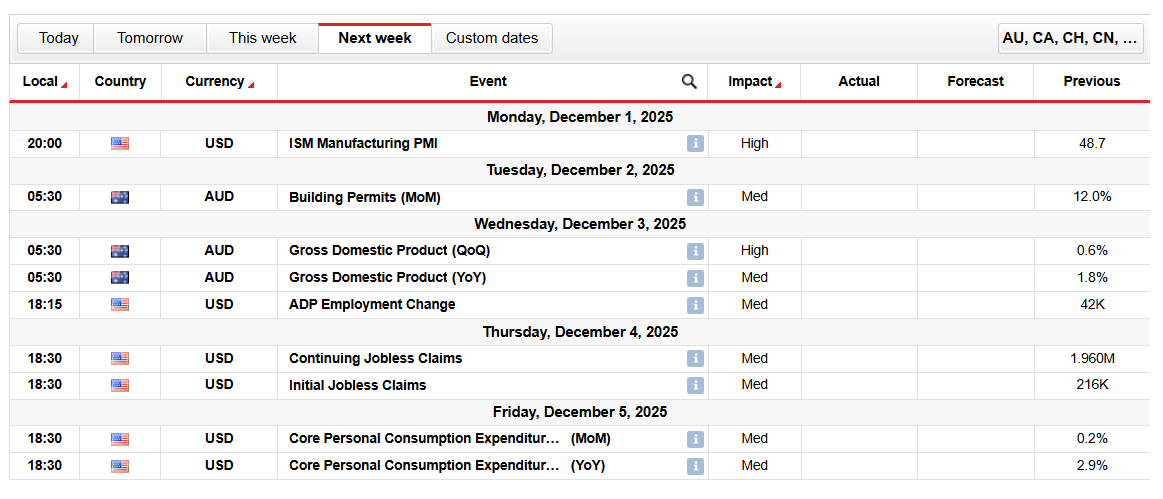

AUD/USD Key Events Next Week

The following week’s direction depends on three variables:

- Australian GDP

- US data (PMIs and Core PCE) and Fed speak

- Risk sentiment, depending on China and commodity momentum

In the event of a Fed surprise, moving away from easing, the AUD/USD could see a resumption of the downside. However, the path of least resistance lies on the upside.

AUD/USD Weekly Technical Forecast: Buyers Eyeing 0.6700 Above 200-DMA

The AUD/USD daily chart shows consistent support by the 200-day MA. However, the price remains within a broad range of 0.6400 to 0.6600. The move above 20-, 50-, and 100-day MAs suggests a solid case for the upside. Meanwhile, the RSI is also heading north at 56.00.

–Are you interested to learn more about crypto signals? Check our detailed guide-

The bulls could ultimately aim for the 0.6700 level, which is the swing high for September. Conversely, dropping down, the pair could test the 200-day MA near 0.6465. Moving below the level could test the demand zone at 0.6370-0.6420.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.