Some investors are bullish on the Australian dollar, even though there are still concerns regarding the Reserve Bank of Australia’s Bond Purchase Program.

The Reserve Bank of Australia announced its decision to keep the interest rates unchanged at 0.1 percent, leaving them at a historical low and in line with analysts’ expectations.

Reserve Bank Governor Philip Lowe announced that the governing board is not planning to raise cash rate levels over the next three years. He also announced the governing board’s decision to leave its Bond Purchase Program under review, highlighting its willingness to do more if it’s required.

Economic Calendar

Beyond the RBA’s announcement, this week has been somewhat slow in terms of the economic calendar. On Monday, the University of Melbourne reported that securities inflation went up by 1.4 percent (year-on-year) in November, after climbing by 1.1 percent in the previous month. In monthly terms, it went up by 0.3 percent, after shrinking by 0.1 percent in October.

The Australian Industry Group reported that the Australian manufacturing sector expanded at a slower pace in November, as the manufacturing index stood at 52.1 after being at 56.3 in the previous month. The Commonwealth Bank Manufacturing PMI, released by both the Commonwealth Bank of Australia and Markit Economics, signaled an expansion of the banking sector at 55.8 in November, though lower than expectations of 56.1.

The RBA reported that private sector credit went up by 1.8 percent in October (year-on-year), after gaining 2.4 percent in the previous month. In monthly terms, the figure remained unchanged.

On Tuesday, the Australian Bureau of Statistics reported that building permits rose by 3.8 percent in October (month-on-month) after an increase of 16.2 percent in the previous month and higher than predictions of a 3 percent contraction. In yearly terms, building permits went up by 14.3 percent, after climbing by 8.8 percent in the previous month.

Australian Dollar Languishes

So far this week, the Australian currency has had a poor performance, losing by 0.49 percent against the US dollar and breaking a four-week gaining streak. November ended up being a good month for the Aussie, in which it gained 4.54 percent against the greenback and recovered from a two-month losing streak.

The late volatility of the Aussie can be linked to the most recent news from China. The Asian country reported that its manufacturing sector expanded in November, as the Manufacturing PMI went up to 52.1 and above expectations of 51.5. Similarly, the services sector expanded, with the non-manufacturing PMI standing at 56.4, also higher than expected.

This ended up being good news for the Aussie, which opened the week in positive territory, though posting mild gains. Nevertheless, the Aussie’s early advances were undermined by the US government’s decision to add two Chinese firms to its defense blacklist, further affecting the already complicated trade relationship.

Some investors are bullish on the Australian dollar, even though there are still concerns regarding the Reserve Bank of Australia’s Bond Purchase Program. An example of this is Morgan Stanley’s expectation that the upcoming global economic recovery will end up benefiting risky currencies like the AUD.

“Combinations of strong growth, ample global liquidity, and a solid fundamental outlook for risk assets suggest that risk-correlated currencies should continue to see tailwinds,” reported an analyst at Morgan Stanley.

Nevertheless, this possible trend could be undermined by the Reserve Bank of Australia, as the excessive appreciation of the currency could end up being prejudicial for the Australian economy.

Economy Currently on Path Towards Recovery

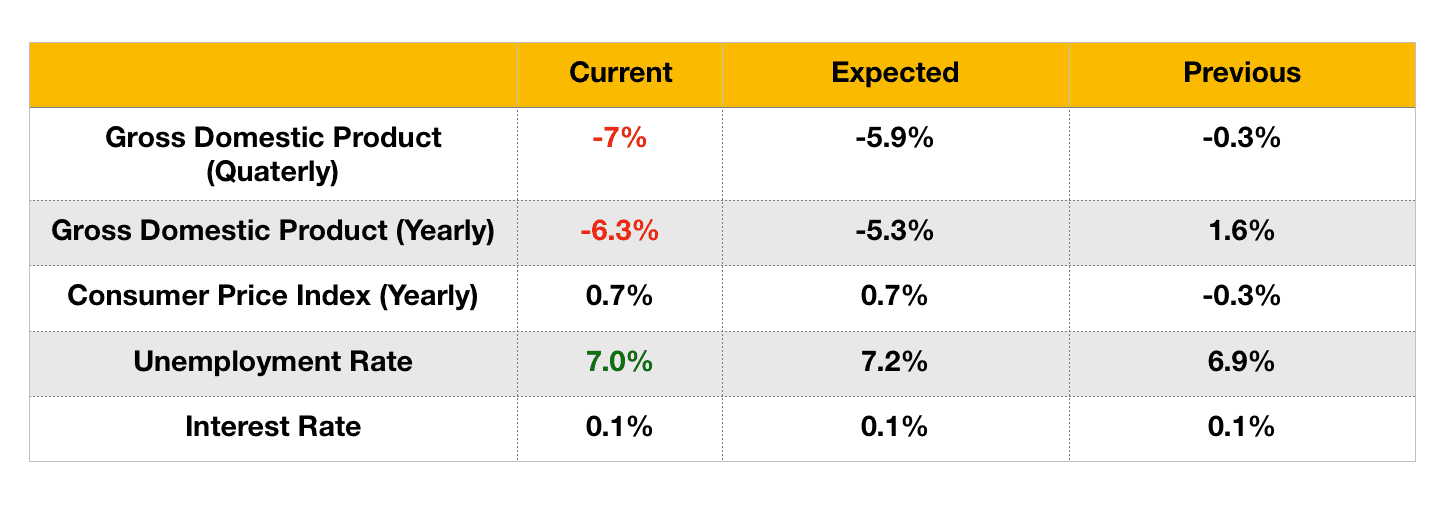

According to the most recent data, the Australian economy has been struggling with the consequences of the coronavirus pandemic. The latest gross domestic product figures, released at the beginning of September, showed that the economy contracted more than expected, shrinking by 7 percent (year-on-year) after decreasing by 0.3 percent in the second quarter. In yearly terms, the figures followed the same trend, falling more than expected at -6.3 percent, after climbing by 1.6 percent in the first quarter.

All eyes are now on the upcoming national accounts report, which is set to be released by the Australian Bureau of Statistics on Wednesday. The surveyed analysts expect a 2.6 percent expansion (quarter-on-quarter), as well as a yearly 4.4 percent contraction.

Inflation is currently under control, as the latest Consumer Price Index figure stood at 0.7 percent (year-to-year), in line with polled analysts’ expectations and higher than the previously reported -0.3 percent. Despite being congruent with analysts’ forecasts, the figure is still way behind the Reserve Bank of Australia’s target, which is currently a 2-3 percent range.

On the other hand, the latest unemployment rate was better than expected at 7.0 percent in October, though an increase from the previous month’s 6.9 percent.

In its latest release, the Reserve Bank of Australia reported that data “have generally been better than expected” and that Australia is currently on the path towards an “uneven and drawn-out” economic recovery. This recovery is also heavily dependent on policy support which, given the latest inflation and unemployment data, will be needed for some time.

Upcoming Events

-

Tomorrow, the RBA’s governor Phillip Lowe will be giving a speech at 00:00 GMT.

-

Also tomorrow, the Australian Bureau of Statistics will release the gross domestic product figures for the third quarter.

-

On Thursday, the Australian Bureau of Statistics will report October’s trade balance, followed by exports and imports of goods and services figures.

-

Retail sales figures will be released by the Australian Bureau of Statistics on Thursday.